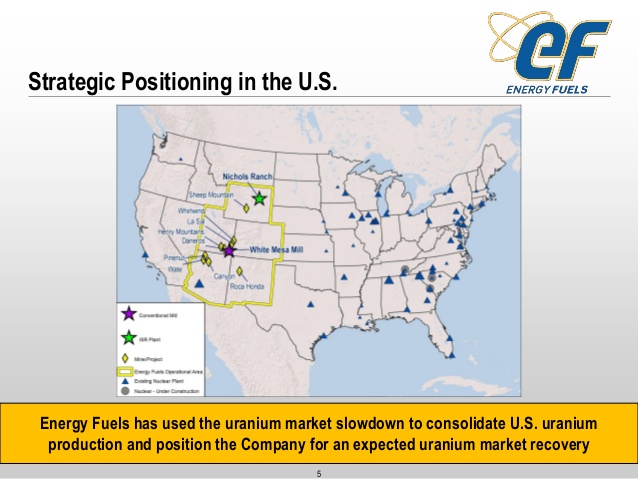

For many years, I have asked my readers to learn more about our national security being totally reliant on foreign imports of our must crucial minerals and metals needed for our newest technologies. At times I even suggested to contact your local elected officials and make them aware of dire importance of a domestic secure supply of these most critical elements. I have been warning for close to a decade about a coming crisis among modern industrial nations posed by China's draconian and monopolistic maneuvers in the implementation of a rare earth quota system. See the full article on Seeking Alpha written more than seven years ago entitled, "The Fast Growing Rare Earth Crisis In The United States".

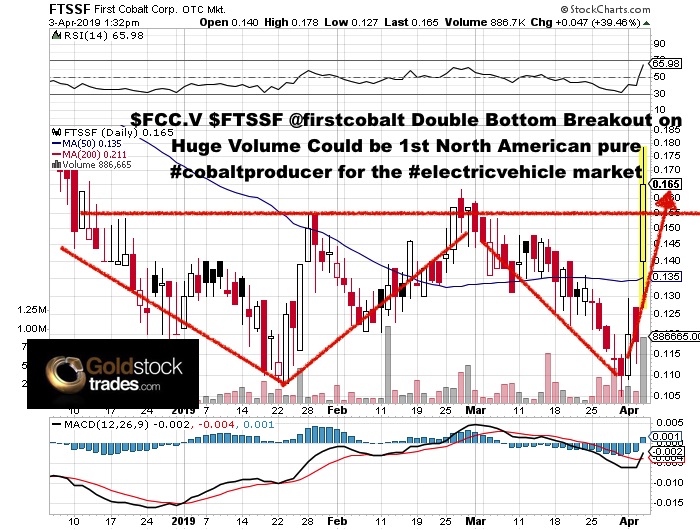

Fast forward eight years after little support from Obama, the rare earth industry (REMX) as well as other critical battery and clean energy metals such as lithium, cobalt, graphite ...etc could receive an important boost. Late last year under the new Trump Administration an executive order was signed ordering federal agencies to end this monopoly of critical metals by China. Lithium Ion Battery materials was identified as crucial for America's economic future to have a secure domestic supply.

Read more