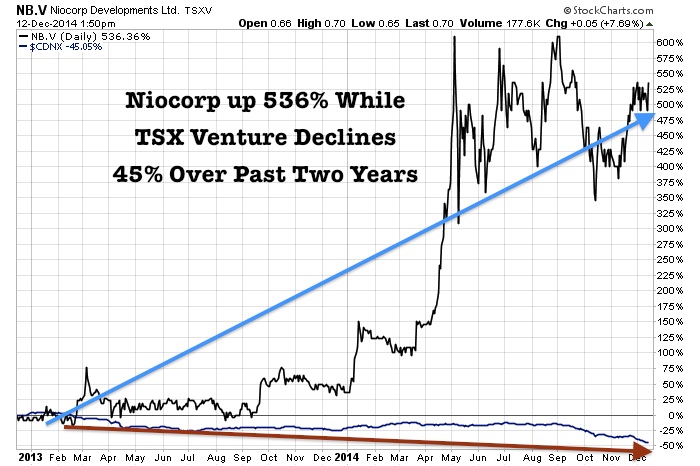

Despite the TSX Venture being down over 25% this year, three of our featured stocks had great gains. Niocorp (NB.V or NIOBF) is up 387% on the year, Western Lithium (WLC.TO or WLCDF) soars 127% in 2014 and Canamex (CSQ.V or CNMXF) rose 108% this year. In a historic bear market, 9 out of 10 stocks fail. As the old adage states, "When they raid the house, they get them all." However, I have been blessed in that most of our featured companies are hanging in there and two of them more than doubled and one almost quadrupled in one of the worst years in resource history. This indicates to me that our system of research and due diligence is improving and should show outsized gains once the 200 day moving average begins sloping higher.

Read more

How To Find The Junior Mining Winners During a Historic Bear Market in Natural Resources