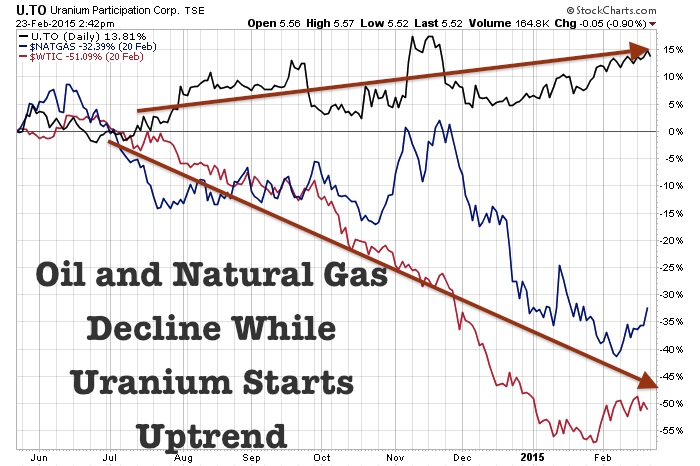

In 2014, I highlighted in many reports the increasing capital flowing from the oil and natural gas sector into nuclear power. Over the past nine months, my prediction that nuclear power will be the leader of the energy sector is coming to fruition as institutional investors flee the dirty fossil fuel industry for clean and cheap nuclear power.

Read more

Energy Sector Rotation: Capital Fleeing Fossil Fuels For Nuclear Energy