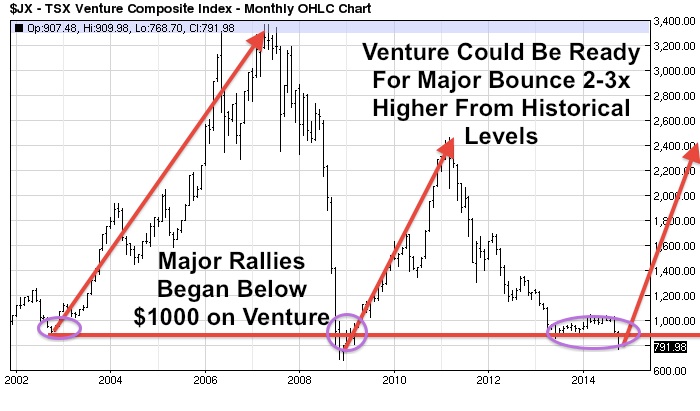

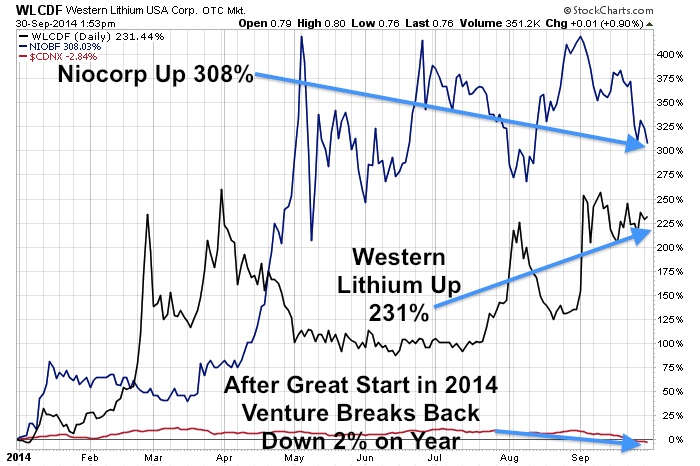

I have been expecting a major long term bottom in the precious metals after major capitulation. The liquidation may have occurred this week as investors sold out of panic and fear rather than take a look at the long term fundamentals. Across the board many of the weak hands had to sell quality assets for pennies on the dollar. Smart resource investors expecting capitulation have had some of their bids filled at ridiculously low prices. Fortunes are made by the brave who pick up real assets when the majority is not interested in them. I expect a major bounce at 2008 credit crisis lows and the 2003 breakout on the HUI Gold Bugs Index at $150. I told my premium subscribers I was buying Pershing Gold (PGLC) at major lows at or below $.30. I believed that the company was due to break its downtrend and 50 day moving average. Now a few weeks later it appears Pershing has broken above the 50 day moving average and has broken out on a relative strength chart versus the Junior Gold Miner ETF (GDXJ). See charts by clicking here...

Read more

Accumulation Follows Capitulation As Day Follows Night in Junior Mining Sector