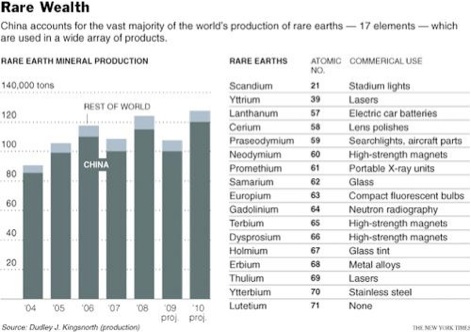

Wars are being fought all over the world over control on natural resources. Attention is focussed on Eastern Europe and the Middle East particularly Iraq. I am greatly concerned that not enough is being done by the U.S. to secure critical materials of heavy rare earths needed for cruise missiles and our latest military technologies.

We still rely completely on China despite their export cuts and warnings to the West to mine and refine your own rare earths. Heavy rare earths are increasingly needed in permanent magnets crucial for some of our defense technologies.

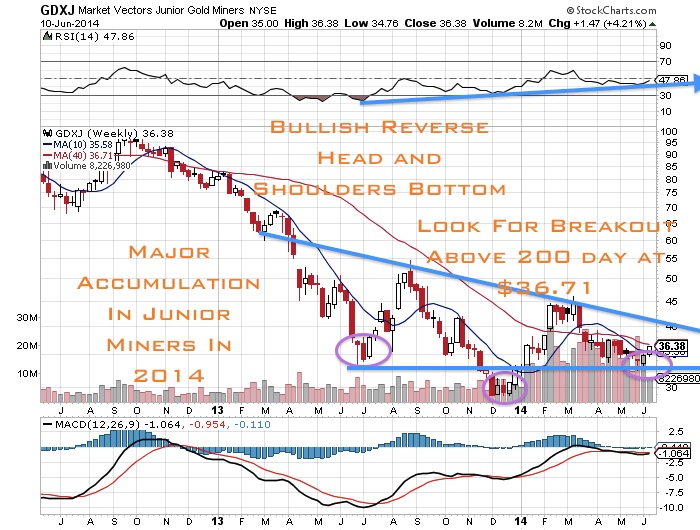

China has been warning the world for years that they will cut exports. The U.S. can't be reliant on another country for these basic elements. One day we could wake up left out in the cold and naked if we don't start getting our act together. The Alaskans understand the importance of strategic metals and are financially supporting this junior heavy rare earth developer...

Read more

U.S. Must Secure Heavy Rare Earths From This Alaskan Mine