Wall St. tends to attract investors to stocks that the crowd is

bidding up, while ignoring companies that are trading at significant

undervaluations to their peers and to the overall market.

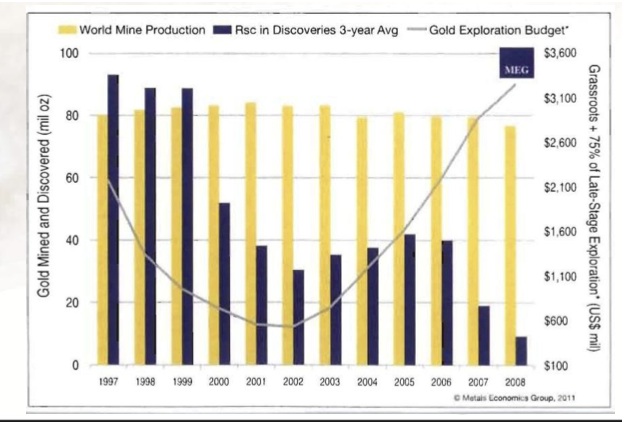

This gold miner is developing one of the largest mother-lodes of gold

(20+ million ounces) right here in the United States in the mining friendly

area of Fairbanks, Alaska.

Read more

This Gold Miner Is Trading At A Significant Discount To Bullion