The gold and silver market is consolidating and may be forming the right

shoulder of a reverse head and shoulders pattern. The European Debt Crisis

appears to be escalating once again.

This may be very bullish for precious metals and mining shares as they represent safe havens. For many weeks we have been calling for a rotation from overbought equities into precious metals and miners, especially the juniors.

Junior mining stocks are at record oversold levels, rarely seen by investors.

This may be representing a historic bargain basement buying opportunity. Long term

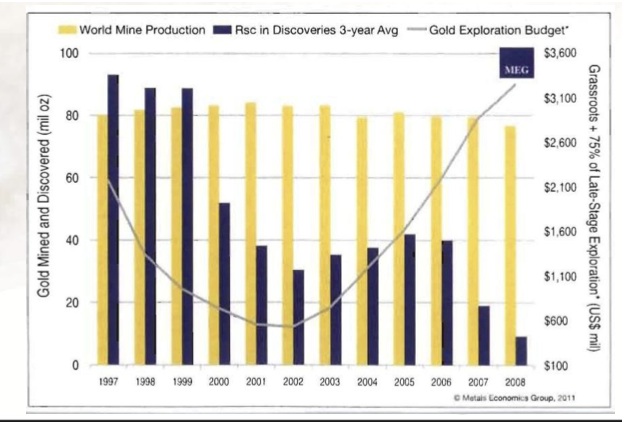

mining investors are aware that the rate of new gold discoveries is

decreasing despite record exploration expenditures.

Enter center stage, a rising project generator such as Miranda.

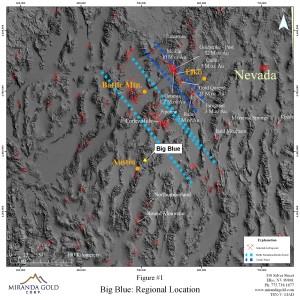

Nevada's Cortez Trend may be the flagship for a major miner such as

Barrick, which has plenty of cash, but is constantly in need of new blood.

Miranda may well be fortunate to have at its helm such experienced

exploration mining men as Joe Hebert. He knows the territory, having

explored Nevada for decades. Joe was instrumental in what is now Barrick's

multi-million ounce flagship discoveries while he was at Placer Dome.

Barrick bought out Placer and acquired the Cortez properties.

Miranda just announced that Ramelius Resources, their partner at Big Blue, has started the 2012 drill campaign.

Ramelius has returned for a third round of drilling. This shows confidence that they are getting closer to a discovery. Read the full press release by clicking here...

In a recent interview with Ken Cunningham, CEO of Miranda Gold (MAD.V or

MRDDF), we discuss Miranda's other major Nevada Target, the Red Hill project which is on trend with Barrick's Red Hill/Goldrush discoveries. Miranda's drill hole BRH-013 is the most significant intercept outside of Barrick's holdings in the Cortez

Trend. A positive development so close to Barrick could possibly generate

interest. Watch the interview below.

Disclosure: Long MRDDF and GST Featured company

Please do your own due diligence before investing.