Despite equity markets hitting new highs many of the sectors were already in decline. This historic crash over the past week has been fueled by one of the most overbought markets that I can remember since the dot com bust. After the dot com bust investors sought out value in the deeply discounted commodity sector and junior miners. I expect history may not repeat but it should mimic. After the dot com bust junior mining was the place to be.

Read more

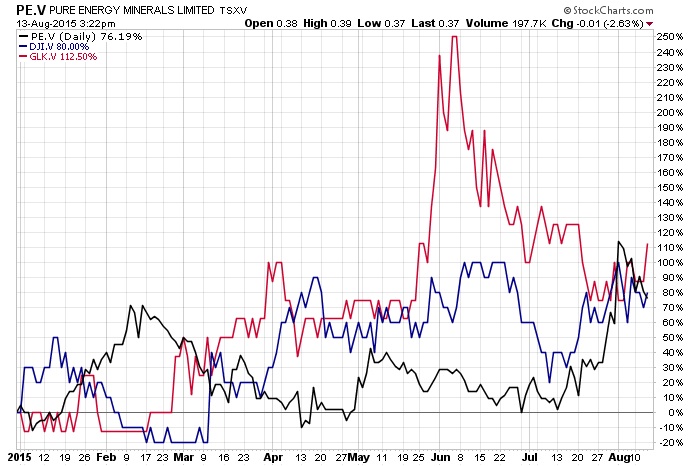

Post Stock Market Crash, Will Investors Look To Junior Gold Miners as a Hedge?