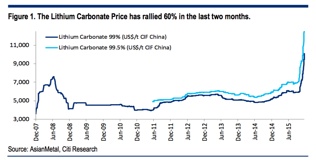

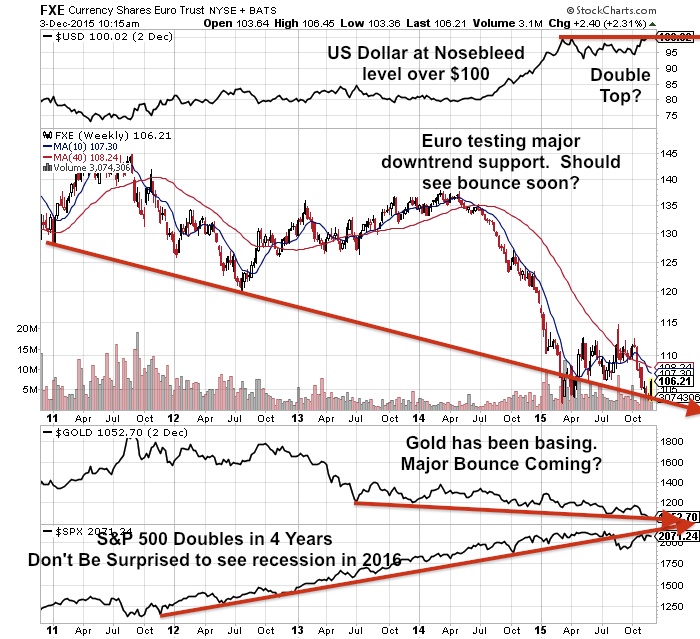

Over the past year I have studied the content of my blog and would like to report which are my top articles and videos in terms of unique page views in 2015. Clearly, my top content in terms of interest from readers in 2015 was the lithium sector where we are continuing to see demand outstrip supply. It was one of the only commodities rising in price while the sector was wiped out by a strong dollar. The August correction in the stock market brought back retail interest over the summer. I expect as tax loss selling ends today to begin to see a rally in the new year. This rally is called the January Effect where beaten down sectors bounce as fund managers look to re-position in the new year.

Read more

Lithium Continued To Excite Investors in 2015, Will Stock Market Crash Bring Back Interest to Junior Mining?