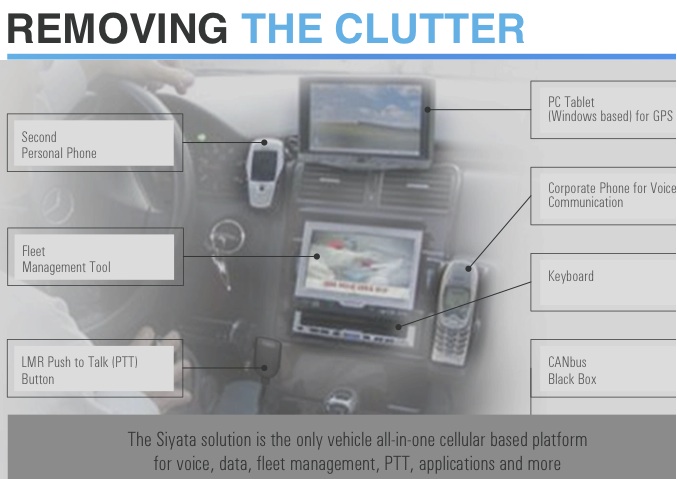

There is a company gaining market share due to the recent acquisition of Motorola by Google. In 2011, Google bought Motorola for its Android Operating System addressed for consumers in the use of smartphone and then sold off the rest of Motorola to other outfits. This left a huge void in Motorola’s Business Unit which sold “connected-vehicle” devices to fleets across the transportation sector. Its a big $7 billion market that this small company is looking to build its market share.

Read more

Motorola’s Acquisition by Google Left a $7.2 Billion Void in Niche Market