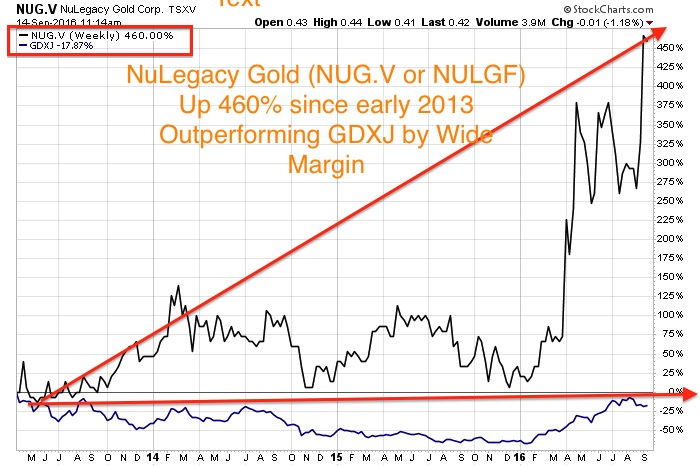

Since I first wrote about this stock in March of 2013, this junior has soared more than 400% while the Junior Gold Miners Index is still way below 2013 levels. This demonstrates the importance of sticking to the top management teams that have a track record of success and the creation of value that arises from a new discovery.

Read more

Look to the Junior Gold Miners For Outsized Gains To Precious Metals