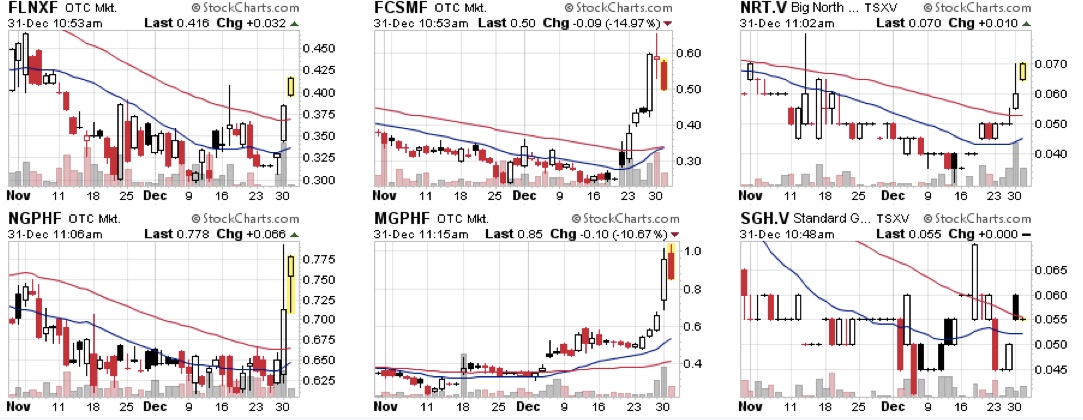

I have been carefully scouring the resource markets for exceptional opportunities over the past few months and indicated numerous times about the potential rebound and breakout in uranium, graphite, PGM's and rare earth mining stocks. At the end of October, I said to watch for a rebound in uranium as major volume accumulated shares of Uranium Participation Corp which has now just broken out into new nine month highs and made a bullish golden crossover of the 50 and 200 day moving average. In addition, I highlighted a few months ago to buy NYSE graphite bellwether Graftech and some of the high quality graphite miners. All these graphite stocks mentioned above have been breaking out on major volume this week as predicted. I also told you about increased M&A in the rare earths and graphite sector. Now Molycorp has just broken out on huge volume as even this giant could be a takeout target of Molymet as it trades below book value.

Read more

Are the Uranium, Graphite and Rare Earth Miners Ready To Breakout?