Gold and silver are moving higher as the record short position begins to unwind. Look for a powerful move and double bottom in gold and silver as demand is soaring in Asia and huge short positions are being covered in the West. When the majors are buying projects at a high premium like in early 2011, when Newmont bought our recommendation Fronteer Gold for top dollar that will once again be a time to be careful and raise cash.

For right now, investors are ignoring undervalued situations such as International Tower Hill Mines (THM) which owns one of the best deposits in North America with over 20 million ounces of gold. But they may not ignore THM for much longer especially if gold turns higher. I have learned that the stories hated during a declining gold price become the largest gainers when the price moves higher.

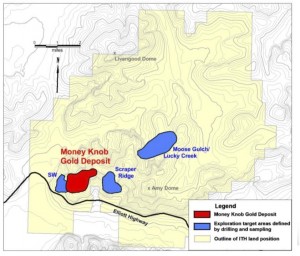

The long term trend in gold remains higher and this correction may provide opportunities for precious metals investors to gain exposure to highly leveraged vehicles to the gold price. International Tower Hill Mines is like an option on the gold price with no decaying time value or expiration. THM's Livengood Asset is one of the largest undeveloped deposits in the world still 100% controlled by a junior. It could produce massive amounts of gold annually. Hundreds of millions of dollars have been spent on this asset with 792 drill holes yet investors can purchase the company for around a $40 million market cap way below its book value. One must remember that current resources are only on 1 sq mile of a 75 mile land package. I believe there may be additional high grade zones like Money Knob on the property.

The project is located in a gold district which has mined precious metals since 1914 and the State of Alaska especially this region is incredibly supportive of this asset. Livengood coming into production over the next decade could provide thousands of jobs for the region and could really boost the economy in nearby Fairbanks. I have been blessed to be able to visit the property.

It is located just off an all season highway. I have known some of the key technical people for several years and they are high caliber with strong moral ethics. They have the experience in permitting and starting up some of the top mines in Alaska such as Pogo and Ft. Knox which are cash cows for Teck Cominco and Kinross.

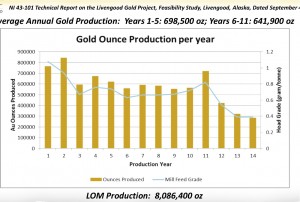

THM released their feasibility study in one of the worst gold mining markets in history. The study showed that they will not be economic until $1500, however if gold should go higher the leverage to the price of gold is extremely impressive. The mine is massive and could produce over 500,000 ounces of gold per year if gold moves above $1500.

With an advanced NI 43-101 feasibility study the management who previously built major Alaskan Mines such as Pogo and Ft. Knox, Tower Hill could attract strategic partners to advance this project. The company is also actively exploring other mine configurations to bring the Capex and cash costs down. It is important to remember that International Tower Hill Mines sports a market cap of around $40 million and has spent over $250 million advancing this project through feasibility. That sounds like a bargain to me.

Listen to a recent interview with the CEO of International Tower Hill Mines Corp Don Ewigleben below.

Disclosure:Author is long THM and the company is a sponsor on website.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...

0 Responses