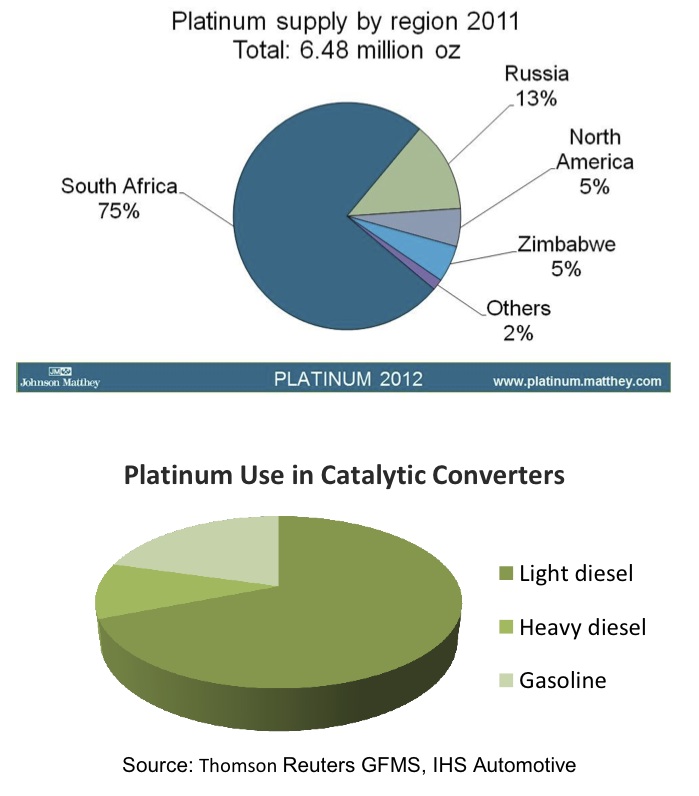

We are approaching the end of the year where investors are facing a confluence of mixed signals such as tax loss selling, fiscal cliff discussions, the Greek bailout, future Fed actions and Middle Eastern geopolitical turmoil. Short term shakeouts like yesterday's early morning drop in precious metals should be expected...Nevertheless, we ignore the daily volatility and stick to the long term technicals and fundamentals which may be signaling that gold, silver, pgm's, uranium and heavy rare earths may reemerge as sectors where opportunity lies in 2013.

Read more

Gold, Silver and Platinum Near Major Breakout Points