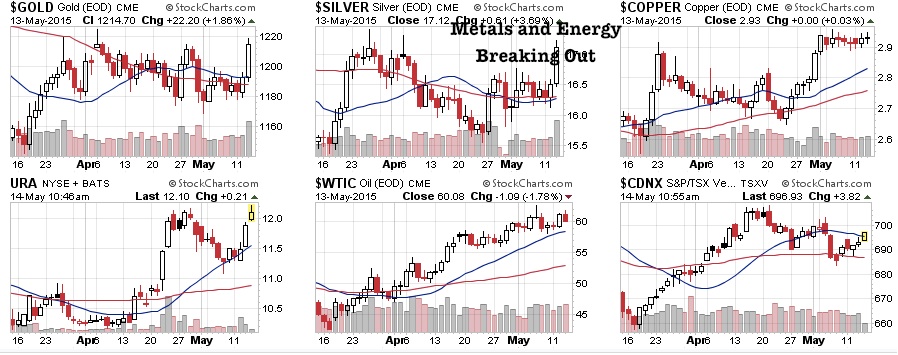

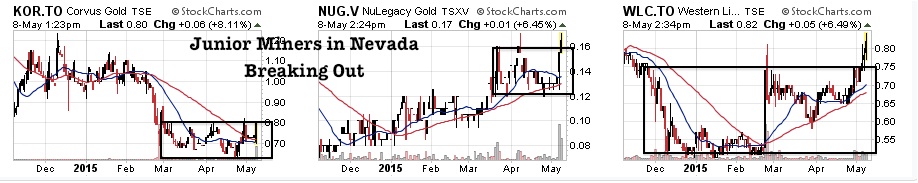

Over the past four years we have seen a huge rise in the general equity markets while most of the junior gold miners have been forgotten. These bear markets in natural resources when financing dries up and mines are closed fuels the next bull market as the supply dries up. The larger and more severe the decline, the greater the subsequent rise. Exploration budgets for metals and energy have been cut drastically over the past few years. Where will the new mines come from once demand picks up?

Read more

Why Is This Junior Gold Developer in Quebec Outperforming GDXJ By Such a Wide Margin in 2015?