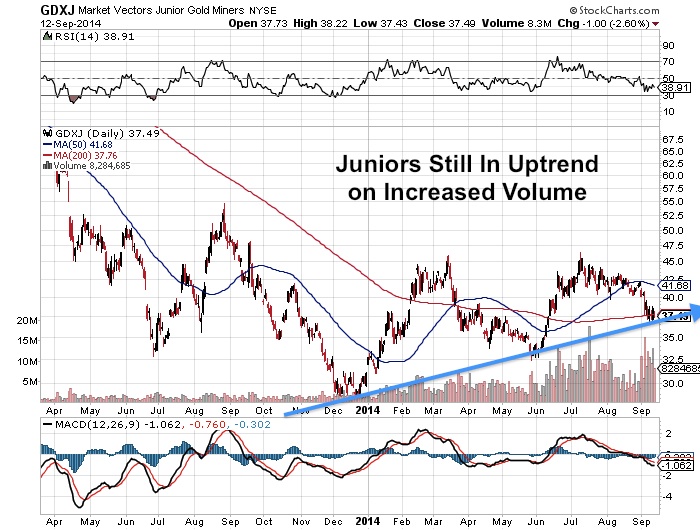

Look for huge volume and accumulation in gold and silver and the junior miners over the next few weeks and in some high quality junior mining stocks. Selling capitulation followed by strong accumulation could be the indicator that the smart money expects gold and silver to bottom. The question for many is when this will occur. Do not forget we are seeing increased interest into the junior miners with oversubscribed financings. What is driving this investor demand for junior gold miners when gold and silver are testing and hitting new lows?

Read more

Strong Accumulation May Follow Selling Capitulation in Junior Gold Miners