Despite the shorts in precious metals reaching record heights, the junior gold miners (GDXJ) continue to find support at the 200 day moving average, a critical area of long term support. This may be signaling to investors that gold may soon bottom around $1200 and that the major miners may start looking for economic deposits to replace current resources that are being exhausted.

If you find quality gold properties near majors with top notch management with track records then you have a good shot to make a profit even through this historic bear market.

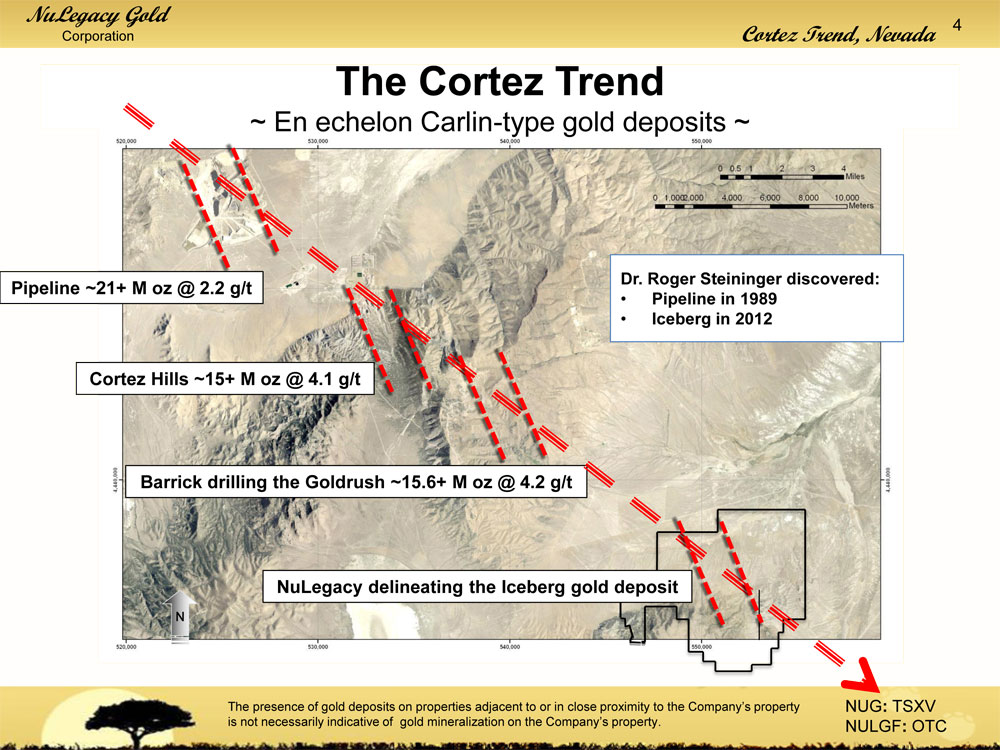

For instance, about a month ago I sent out a report that the "Smart money is looking at the Cortez Trend".

I highlighted a small junior called Nulegacy Gold (NUG.V or NULGF) partnered with Barrick (ABX) which I visited only six weeks ago. Nulegacy may be at just the beginning of discovering a gold deposit on trend with Barrick's three multi-million ounce deposits. These massive deposits are some of the lowest cost and most profitable mines for Barrick in the entire world.

Nulegacy's deposit is next to Barrick's Goldrush Deposit which is one of the best greenfield discoveries in the world with over 14 million ounces of gold. Recently a major billion dollar private equity fund has taken a 19.9% in Nulegacy for $3.5 million which will help Nulegacy expand exploration and earn in to the deal with Barrick. This deal provides financial security for the company and is a significant development in Nulegacy's history.

In addition, Nulegacy has significantly strengthened its board with the addition of Alex Davidson who was the former VP of exploration for Barrick during its major growth years. He was instrumental in Barrick acquiring those profitable Cortex Mines from Placer Dome. He retired from Barrick in 2009 but is still recognized in the mining exploration circle.

In conclusion, I was early highlighting this story more than a year ago at under a dime and you may have not believed me when I told you that Nulegacy owns prime real estate in the Cortez Trend. Its understandable at that point to be a little skeptical with an early stage explorer in Nevada. However, after seeing a major private equity firm become a 19.9% strategic partner and seeing old time famous veterans from Barrick such as Alex Davidson joining the board, an investor should be more confident that this is a first class exploration target with the potential to become a major resource for Barrick. Take a look at Nulegacy before the potential breakout as two drill rigs are on the property.

Disclosure: I am a Nulegacy shareholder and the company is a website sponsor. Conflicts of interest apply and one should do their own due diligence.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

To send feedback or to contact me click here…

Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

0 Responses