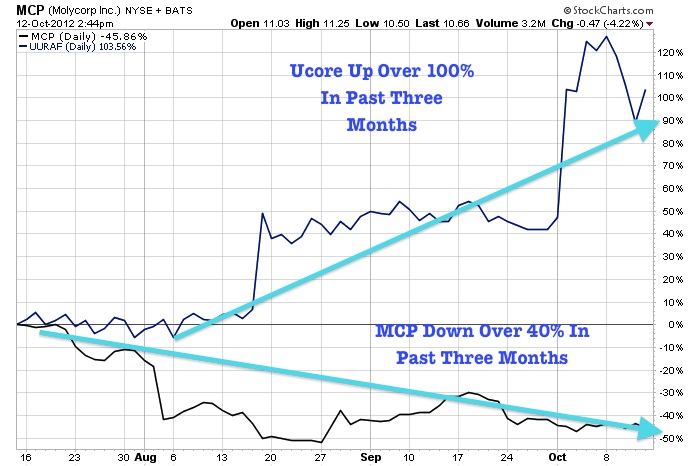

The miners are already beginning to outperform both bullion and the S&P 500 and we believe this trend will continue due to favorable fundamentals and seasonality. For the past six months, the silver miners (SIL) and gold miners (GDX) have outperformed.

We expect this trend to continue as investors see possible weaker earnings and slowing growth in the large caps yet rising inflation and commodity prices, which benefit the miners. Notice that even during this pause in the rally both the gold and silver miners are holding up well versus the S&P500 and are outperforming bullion. The miners may be forecasting a coming breakout in gold at $1800 or a rotation from large caps to miners. After this breakout look for the large miners with rising share prices to make deals with the cheap junior gold miners for large premiums.

Read more

Why The Miners May Outperform Gold After The Election?