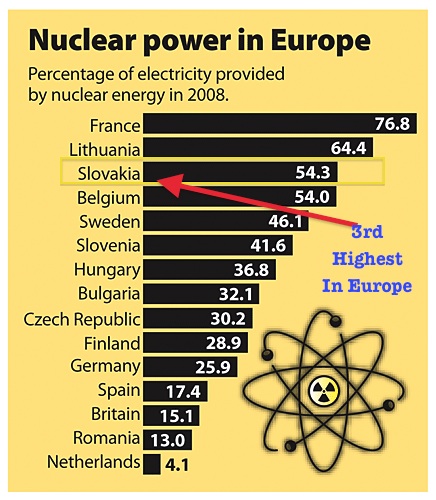

Europe needs nuclear power and is searching for domestic uranium assets. Nuclear remains a vital component of Europe's energy mix. Europe currently has approximately 160 working nuclear reactors.

Most of Europe realizes that nuclear power is vital for its future. Poland, Finland, Slovakia, Spain are all going full speed ahead to develop new next generation nuclear reactors.

Currently, Europe as a continent, is the largest per capita consumer of nuclear power generation. Despite being such a large consumer, it only has one uranium mine in production.

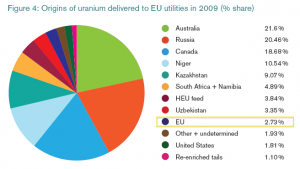

Europe is a major importer of uranium as there are major supply issues and Europe must develop domestic assets.

Slovakia recently elected a new pro nuclear Prime Minister who is a major supporter of nuclear energy. The party believes domestic assets such as European Uranium's (EUU.V) Kuriskova Project should be developed.

Slovakia is a member of the European Union and it is highly unlikely that the project will be threatened by resource nationalism like we are seeing in South America and Africa.

Recently, nuclear giant AREVA became a major shareholder and sits on European Uranium's board as they are interested in the low cost of production and extremely high grade at the Kuriskova Project. Areva paid $.35 for the deal so new investors could purchase shares significantly discounted to that placement.

This is a major stamp of credibility and prestige as European Uranium (EUU.V) emerges from a junior explorer into a developer of Europe's next uranium mine with the backing of a major nuclear institution.

This relationship with AREVA may accelerate development of the project as AREVA has access to some of the best engineers, metallurgists and mine developers assisting on the project.

Once Kuriskova is in production it could provide Slovakia with all the uranium it needs with just 25% of production. The 75% can be sent to hungry neighbors such as Poland, Romania, Great Britain and France who are all building additional nuclear reactors.

AREVA may be focussed on European Uranium's Kuriskova Deposit.

AREVA provides metallurgical expertise and engineering assistance which is very unique for a small cap company.

European Uranium is trading at a market cap of below $15 million with over $7 million in cash and no debt.

The company has a strategic shareholder AREVA that at anytime could acquire Kuriskova for pennies on the dollar. The market is valuing Kuriskova at $8 million.

The recent NI 43-101 Pre-feasibility came out with an NPV at 5% at $374 million.

This means the project is currently valued at pennies on the dollar.

We expect significant developments in the second half of 2012 as the trend appears to be moving higher. Support has held at $.20 and momentum has been increasing. We believe that we could test May lows or possibly go a little below it to form a double bottom. Look for a breakout above the 200 day moving average and the August high at $.325.

Disclosure: Author is long European Uranium and the company is featured on our free website.

Subscribe to my premium service to be the first to receive my reports by clicking here…

Accredited Investors, Fund Managers and Mining Professionals click here…