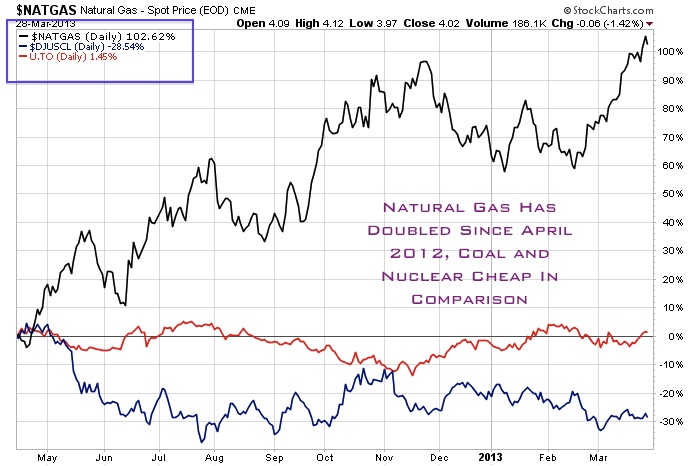

In theater a farce is a comedy that uses disguises, costumes and ruses to make believe unlikely scenarios. Over the past couple of years, we may have witnessed this bizarre script play out in the energy sector. For awhile, one common belief among investors has been that fracking is the panacea that would solve the world's energy problems. Many investors ignored the coal and nuclear sector as a viable alternative. However, for many months I warned my readers to be careful of what you read. Natural gas is historically volatile and that coal and nuclear is crucial for modern industrial nations to utilize in their energy mix. Natural gas is now breaking the $4 barrier and appears to be headed higher as supplies are tight due to increased demand and limited production. There is also increasing public opposition to fracking from the public, especially with regards to groundwater contamination. Natural Gas has doubled since the peak of the fracking bubble. For over two years the coal and nuclear stocks have been ignored by this fracking farce that natural gas would be the sole source of our energy future. Now coal and nuclear may once again be seen as a competitive alternative.

Read more

Natural Gas Breaks $4 Barrier, Comeback For Coal Miners?