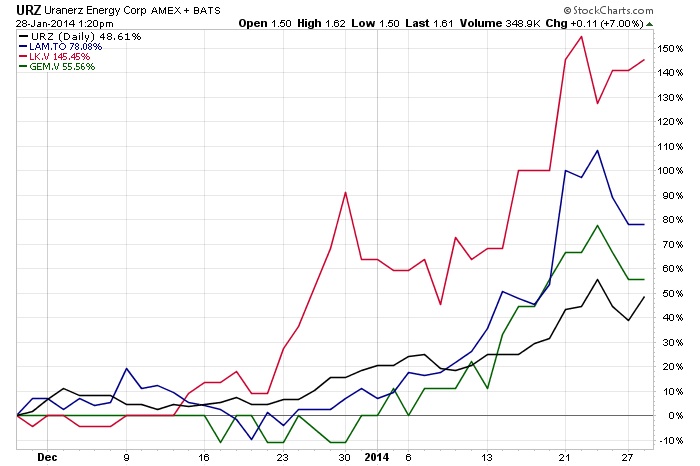

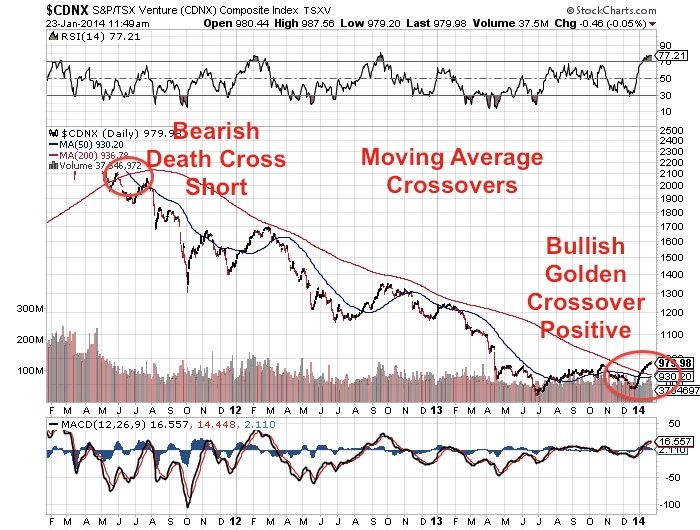

We are almost at the third anniversary of the once in a millennium Fukushima Disaster. Lessons have been learned from the accident. The nuclear sector is once again rebounding, getting up off the mat and making a late round comeback. The uranium miners are just beginning to breakout forecasting that the uranium price may be on the verge of a reversal off of 8 year lows. Cameco (CCJ) and Uranium Participation Corp. (U.TO), the two major bellwethers for the sector may be just beginning to make a move. Cameco just hit a new two year high.

Read more

Uranium Miners Spiking Higher in 2014 As Utilities Face Supply Shortfall