The world is carefully monitoring the ties between Japan and China as tensions have created conflict in the Asian Region. The issue is over islands in the South-East China Sea where China is in dispute with many nations.

Japan is seeking the assistance from the U.S. and other Asian nations to help with a situation which could spiral out of control. The Chinese have a new political leadership which may be demonstrating a more nationalistic approach.

The U.S. plays a critical role as they may be concerned about China’s growing power in the region. Japan is the world’s third largest economy and Abe’s government is investing billions into automakers, infrastructure and high tech.

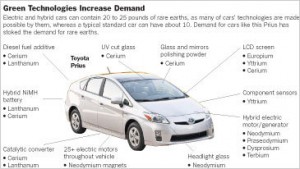

This will require increased amounts of the critical rare earths that are in complete control of the Chinese. China, who supplies 99% of the heavy rare earths, just announced that they will cut export quotas again. These metals are critical for our most advanced military equipment such as cruise missiles, stealth aviation and helicopter blades. It is also critical for high efficiency lighting, green energy, wind turbines and hybrid cars.

The World Trade Organization already reported that China’s policies to control rare earths are not fair trade. Do not be confused by some who say the reduction is small. It is small with regard to light rare earths where over 13k tons will be allowed to be exported versus less than 1,800 tons of heavy rare earths.

We just ended tax loss selling so our beaten down miners were hit hard as expected. Remember we have been in a three year decline and net capital losses can be carried back three years. This may the bottom and over the next few trading days could provide us with a historic buying opportunity. Investors are selling these assets regardless of the value to offset the capital gains in other sectors. As we begin the new year look for a bounce in the oversold rare earth and graphite market.

Its the investors who buy at bargain prices in December who will be able to sell in May with a profit. How much more so when there has been three years of declines. Those who sell can not repurchase the same securities for at least a month, so we may see a rotation into some of the higher quality names in the resource space.

Keep a close eye on Tasman Metals (TAS) who will merge with Flinders for shares. The stock is already in a major six month uptrend and seeing increasing momentum. Look for a bullish MACD reversal and breakout above $1.10 after tax loss selling.

I agree that both companies complement each other nicely as they are both focussed on metals and materials that are in critical supply to European industries especially the German manufacturers which dominate the automobile and industrial sector.

Now Tasman (TAS) will have the world class Norra Karr Heavy Rare Earth Project, Flinders Woxna graphite deposit which may be one the first large flake graphite producer in the junior industry in the 3rd Quarter of 2014, plus they are doing work on a tungsten project near Norra Karr.

All three of these materials are considered critical by the European Commission. More companies should follow Tasman’s lead and merge entities to help support a larger market cap, nearer term cash flow and focus on several critical metals.

This is a great move for Flinders shareholders as Tasman’s NYSE-MKT United States listing will allow U.S. investors to gain exposure to graphite and tungsten in addition to rare earths. All these metals are at risk of a supply shortfall in the near term.

The nearer term production that could come from Flinders could help the development of Tasman’s tungsten and rare earth assets. This could help generate more interest from institutions looking to invest in critical metals that can be independent from the Chinese. The end users for graphite are some of the same end users for tungsten and rare earths so there is a lot of overlap. Tasman is quickly becoming the critical metals answer for Europe and I am very excited for 2014, which could be a breakout year.

For additional information on the merger, please contact:

Jim Powell, VP Tasman Metals

Telephone: +1 647 478 5806

Disclosure: I am a shareholder of TAS and the company is a sponsor of my website.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...