I just read Trump's inaugural speech and it can be summed up in the following sentence, "Buy American and hire American". This policy could have a great impact on some of our US natural resource holdings including our investments in US precious metals, rare earths, graphite, lithium, uranium...which have been forgotten about for nearly twenty years as large mining companies sought mines in foreign jurisdictions which had less regulatory burdens then the US. For years I expected a renaissance in this abandoned mineral sector as a country can last only so long before people realize that their jobs have been sent overseas.

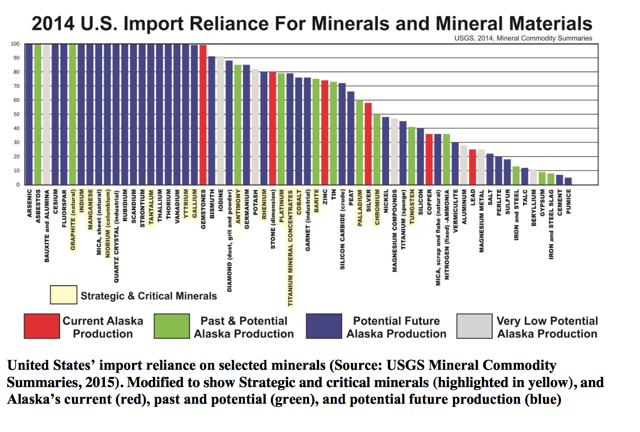

Our mining and manufacturing industry has been demolished over the past twenty years being sold for pennies on the dollar to foreign interests. It seems that some of the themes I have been investing in is world class mining assets in the US will now come back into favor as we should no longer import these strategic minerals from China and Russia at inflated prices.

We can mine and produce these clean energy metals right here in the US if We can transform our regulatory and taxing policies to support mining rather than make it nearly impossible to build a mine or factory through burdensome permitting and regulations. Mining in the US could change now with a completely right wing and nationalistic swing in the US.

Although the stock markets have been rising business in the US has been very slow. Now maybe Main Street (the real economy) will start catching up to Wall Street (the perceived economy). I believe most of Wall St. gains were pumped by artificial QE in the trillions keeping interest rates artificially low which promoted value in dividend paying blue chips.

That is unwinding now. Bonds are in free fall. The dollar is topping and finally commodities are breaking out. Even the Post Fukushima hated uranium sector is booming despite Cameco's the largest uranium producers attempts to calm down the rally. Capital still keeps flowing in to uranium. I expect domestic oil to benefit from America first. Big money could return to the energy sector. However, the biggest gains could be in lithium, graphite and cobalt.

Pay attention to Graphite One $GPH.V $GPHOF as they are anticipating a Preliminary Economic Assessment on its Graphite Project any day now.

I expect the large battery makers especially the ones in Nevada may look to source their graphite from this critical Alaska asset. This graphite is strategic for batteries and national security applications. Despite the need for this critical material we completely import this material from China. This should change under President Trump and could benefit Graphite One shareholders. Notice the stock is breaking through the 200 DMA to the upside on above average volume. It may be just the beginning of a major move...stay tuned.

In other news pay attention to the discovery made in the Yukon by Golden Predator $GPY.V in the Yukon at 3 Aces. They hit some high grade gold and discovered a new blind vein. The stock broke out on huge volume on the news and this should benefit Bearing Resources $BRZ.V who sold its Yukon Claims to Golden Predator for cash and shares prior to this discovery.

Jeremy Poirier, President and Chief Executive Officer of Bearing $BRZ.V commented: "We are very pleased to have entered into this agreement with Golden Predator and believe this transaction is an excellent opportunity for the Company to take advantage of a strong gold market moving forward. We look forward to becoming a shareholder of Golden Predator."

In addition to having shares of Golden Predator which is making a new discovery, Bearing may be on the verge of closing one of the most significant lithium deals yet. They intend to acquire close to 18% of an advanced high grade lithium asset in which $30 million has already been invested in the heart of Chile's Atacama. In addition the project expenditures are fully funded through Feasibility by its JV partners. An update resources is planned which could really bring attention to this asset. Remember big pools of capital especially from Asia are looking to acquire ownership positions in advanced high grade lithium assets. This project may be one of them.

Disclosure: I own securities in Graphite One and Bearing and they are both website sponsors. This should be considered a conflict of interest as I could benefit from price/volume increase and have been compensated. This is not financial advice and contains forward looking statements which may not come to fruition. Buyer Beware! See full disclaimer and current advertising rates by clicking on the following link:

http://goldstocktrades.com/blog/

Section 17(b) provides that:

“It shall be unlawful for any person, by the use of any means or

instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any

notice, circular, advertisement, newspaper, article, letter, investment

service, or communication, which, though not purporting to offer a security

for sale, describes such security for a consideration received or to be

received, directly or indirectly, from an issuer, underwriter, or dealer,

without fully disclosing the receipt, whether past or prospective, of such

consideration and the amount thereof.”

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.

0 Responses