It appears that New Year 2017 has brought in with it renewed interest and new buy signals in the commodity sector and the junior miners. The TSX Venture is making a parabolic move as all the shorts have dried up and a whole new group of buyers appears to be entering.

The Junior Gold Miner ETF (GDXJ) is breaking a 5 month downtrend and so is the silver miners etf (SIL). Now the next technical bullish breakout is regaining the 200 DMA, which I expect to come quickly.

Uranium Miners ETF (URA) are breaking out of cup and handle breakout along with the Lithium Stocks ETF (LIT) as investors look to clean energy commodities.

Notice the huge volume since the US presidential election. For weeks now I have been highlighting to my readers to be prepared for a nuclear revival under President Trump. For 8 years the nuclear industry has been under attack by ignorant forces who do not realize the potential of clean and reliable atomic energy. This will change dramatically with the new Presidential administration who will no longer allow the US to be reliant on imported uranium and Rare Earths (REMX) especially when we have so much uranium and rare earths in the domestic US that can be mined.

Look at the Lithium ETF (LIT) especially after the recent news of Tesla turning on the Gigafactory producing lithium ion batteries. This should be a catalyst for the sector. Its important to take note of the recent breakout as I expect we could be on the verge of a big increase of interest in this sector which could benefit junior lithium, graphite and cobalt developers.

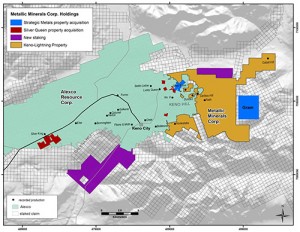

Important news has also crossed my desk this week. I think silver is going to have an explosive move especially high grade silver found in Canada a safe mining jurisdiction. You see a lot of silver comes from crazy places like Bolivia. I love the high grade found in Canada especially the Golden Triangle and Keno Hill where Alexco (AXU) has made a major silver discovery called Bermingham which is getting the geological community quite excited as it is high grade and open at depth which means it could be large as well. This major discovery could also benefit Metallic Minerals (MMG.V or MMNGF) who just added key properties expanding their Keno Hill portfolio 60% with several new high grade targets to be explored in 2017. Remember the Keno Hill district in the Yukon has produced over 200 million ounces of silver with some of the highest grades in the world. See my interview with Metallic Minerals $MMG.V $MMNGF CEO Greg Johnson by clicking here...

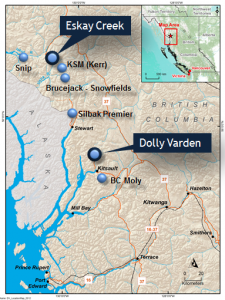

In addition to Keno Hill pay close attention to Dolly Varden (DV.V or DOLLF) who owns an advanced exploration high grade silver asset in the Golden Triangle in Northwest BC. In late November they released drill results which showed multiple areas of high grade expansion. Only a few weeks later they got a new CEO and VP of Exploration who have a known track record for silver M&A. They may have been impressed with the drill results which the market generally ignored at the end of 2016. One should pay attention now.

Disclosure: I own shares in GDXJ, SIL, LIT, AXU, MMG and DV. MMG and DV are website sponsors.

This should be considered a conflict of interest as I could benefit from price/volume increase and have been compensated by those companies. See full disclaimer and current advertising rates by clicking on the following link:

http://goldstocktrades.com/blog/

Section 17(b) provides that:

“It shall be unlawful for any person, by the use of any means or

instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.”

I am biased towards my sponsors (Featured Companies) and get paid in

either cash or securities for an advertising sponsorship.

I own shares in all sponsored companies.

You must do your own due diligence and realize that small cap stocks is an

extremely high risk area. Please do your own due diligence!

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.