Gold is testing July support and multi-year lows, however there are unique junior gold mining equities which continue to stand out.

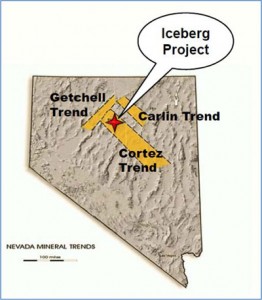

NuLegacy Gold (NUG.V or NULGF) has been hitting some impressive high grade gold on the Cortez Trend in Nevada this past year. Nevada is one of the most profitable and lowest cost jurisdictions especially Barrick's (ABX) mines on the Cortez Trend which I was blessed to visit last year.

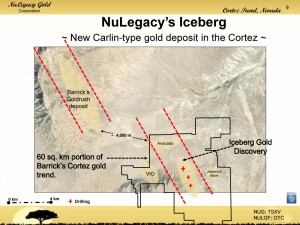

With the depressed price of gold there are very few economic places to mine gold like Nevada. The Cortez Trend is where Barrick produces its most profitable gold and its also where they are making their biggest discovery at Goldrush, which is adjacent to NuLegacy's Iceberg Deposit. In addition to massive discovery at Goldrush, one of their little JV partners NuLegacy Gold is finding high grade gold right next to Goldrush. This could be Barrick's next big gold discovery.

It is my belief Barrick needs to immediately sell off non core assets in outside riskier jurisdictions and build new high grade and low cost discoveries focused on Nevada. NuLegacy could be Barrick's next takeout target.

NuLegacy has discovered a potential Carlin Type deposit with a NI 43-101 compliant exploration target of 90-110 million tonnes of 0.9 to 1.0+ grams of gold per tonne and completed its 70% earn in with Barrick who has three major gold deposits on trend with Goldrush adjacent to this discovery.

NuLegacy management led former National Gold to a buy out for a premium by Alamos Gold (AGI). I believe executives Albert Matter and James Anderson can capitalize on this deal now with NuLegacy and either joint venture or merge with a major producer as they are experience negotiators. I would like to see Barrick do it but it could be a whole bunch of other companies such as Aginco, Yamana, Alamos or Eldorado.

The window for Barrick to elect to earn back in is closing and we should hear a decision in the coming weeks. If they elect to earn in they will have to spend $15 million USD on the property over the next 5 years to earn 70% or they can elect to remain a minority 30% partner. Both options are win-win for NuLegacy as they can either sell the 30% to a royalty company such as Royal Gold, Franco Nevada or Sandstorm or sell the 70% to a larger intermediate producer such as Yamana, Agnico or Alamos who want to establish a presence in the Cortez Trend.

I believe NuLegacy Gold (NUG.V) could see a major transaction over the coming weeks which could provide shareholders with potential gains.

See my recent interview with NuLegacy Gold (NUG.V or NULGF) CEO James Anderson by clicking here....

Disclosure: I own NuLegacy Gold and the company is a website sponsor. Be aware of conflict of interests and do your own due diligence.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.

0 Responses