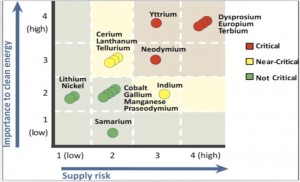

It does not take a rocket scientist to realize that there are a few elements on the Periodic Table that are growing in demand for our latest military technologies and personal computing devices such as smartphones and Ipads. However, there is not much of a secure supply of these materials.

Terbium and dysprosium are two heavy rare earths that are critical for our latest defense technologies and all of this supply currently comes from China. This lack of a secure source is putting our national security and our latest technologies at risk for a supply shortfall.

Heavy rare earth prices have started bouncing higher for these minerals since late November. Increasing tensions with China and The West over natural gas in the South China Seas could continue to support higher heavy rare earth prices.

Senator Murkowski from Alaska now heads the US Senate Committee on Natural Resources and Energy. She is well aware of this supply issue and has supported legislation aimed at securing a domestic supply of these heavy rare earths and has voiced her support for Ucore’s Bokan Project numerous times.

The most advanced and highest grade heavy rare earth asset in the US is located near Ketchikan, Alaska and is owned by Ucore Rare Metals (UCU.V or UURAF) who is advancing a bankable feasibility study on Bokan Mountain in Southeast Alaska. Remember the Alaska Development Agency has pledged to finance the infrastructure costs on the project providing great financial support to an emerging producer.

Ucore just released infill drilling results along with five holes to test for mineralization at greater depth. All five drill results hit results at an average 100 meters below previous drill intersections. There is the potential for a major increase in size and mine life of this project.

See the full news release by clicking on the following link:

http://ucore.com/ucore-extends-bokan-mineralization-at-significant-depth

Ucore continues to outperform the busted rare earth sector by a wide margin and has outpaced former institutional leaders such as Molycorp (MCP) and Lynas (LYSCF) by a wide margin. I expect to see a break above the critical 200 day moving average as we hear further positive developments as they advance the Bokan heavy rare earth project towards feasibility. The Bankable Feasibility Study will allow Ucore to raise funds to start construction on the mine.

Increasing interest may return to this sector as heavy rare earth prices continue to gap higher. Increasing accumulation in 2015 could push Ucore above year long resistance at $.285. Ucore may be the major beneficiary as they own the highest grade and most compelling heavy rare earth situation in the domestic United States.

Disclosure: I own Ucore and the company is a website sponsor. Be aware of any conflict of interest as I would benefit if the share price increases.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Order my premium service by clicking here….

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

To send feedback or to contact me click here…

Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

0 Responses