(Excerpted from Premium Report 5-31-16)

Uranium continues to drop to breathtaking 5 year lows despite being the

most crucial clean and carbon free energy source. However, these low

prices can be cured quite quickly by a black swan and I am positioned for

this sort of move. Attention should be paid to the restructuring of the

deal between Cameco and Kazakhstan. Kazakhstan is the world's largest

uranium producing nation but as I have always written is not a secure

supplier of this strategic clean energy metal and at any time could make

moves to squeeze foreign operators like Cameco or Areva possibly

nationalizing their assets. The Government is being hurt by low

uranium prices and these producers are cutting back due to the low price.

This means Kazakhstan is putting pressure even on the lowest cost producers

in the world. Uranium investors must watch developments in Kazakhstan as

nationalization fears could spark a major rebound in uranium developers and

producer in much safer places such as North America.

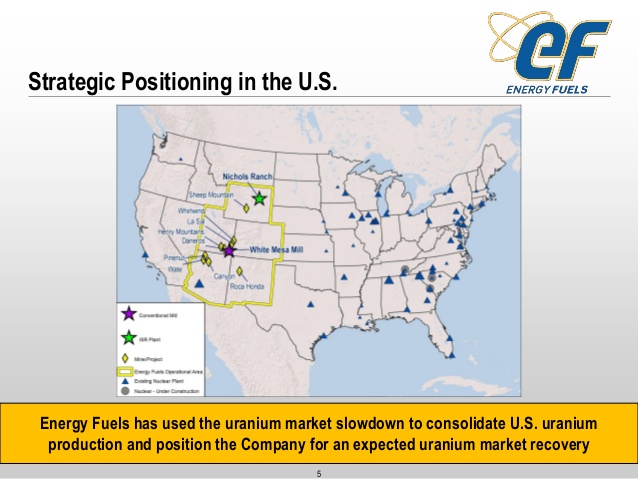

Keep your eyes on Energy Fuels (UUUU or EFR.TO) which is a pure play

American uranium company focussed on conventional and In Situ Recovery.

They have contracts in place with major nuclear power companies and is the

leading pure play uranium producer in the US. They just announced that

they consolidated the Roca Honda Project and now control 100% of one of the

largest and highest grade uranium deposits in the US.

Stephen P. Antony, President and CEO of Energy Fuels stated: “...The Roca

Honda Project is an important component in our strategy of combining

large-scale optionality and leverage to improving uranium markets, with

lower cost production from our Nichols Ranch Project, alternate feed

materials, certain of our Arizona Strip conventional properties, and our

pending acquisition of Mesteña Uranium, LLC...”

See the full news release by clicking on the following link:

Additionally, I want to revisit a company I highlighted to you a few times

called Plateau Uranium (PLU.V or PLUUF) who published a PEA this past year

on their big uranium resource on the Macusani Plateau in Peru. The company

should maybe now be called Plateau Uranium and Lithium as they published an

initial lithium resource after the PEA.

Ted O’Connor, CEO of Plateau Uranium commented: “Although we are a

uranium-focused company, recognizing the presence of lithium and

establishing this large initial lithium resource within only a small

subset of our defined uranium resource base is significant. Lithium has the

potential to add substantial value to our already robust uranium project

as a prospective by-product following uranium extraction. We have only

included lithium resources contained within four of the uranium deposits

considered in the PEA...We will be evaluating a program to analyze a

number of our other uranium deposits for lithium.”

See the full news release by clicking on the following link:

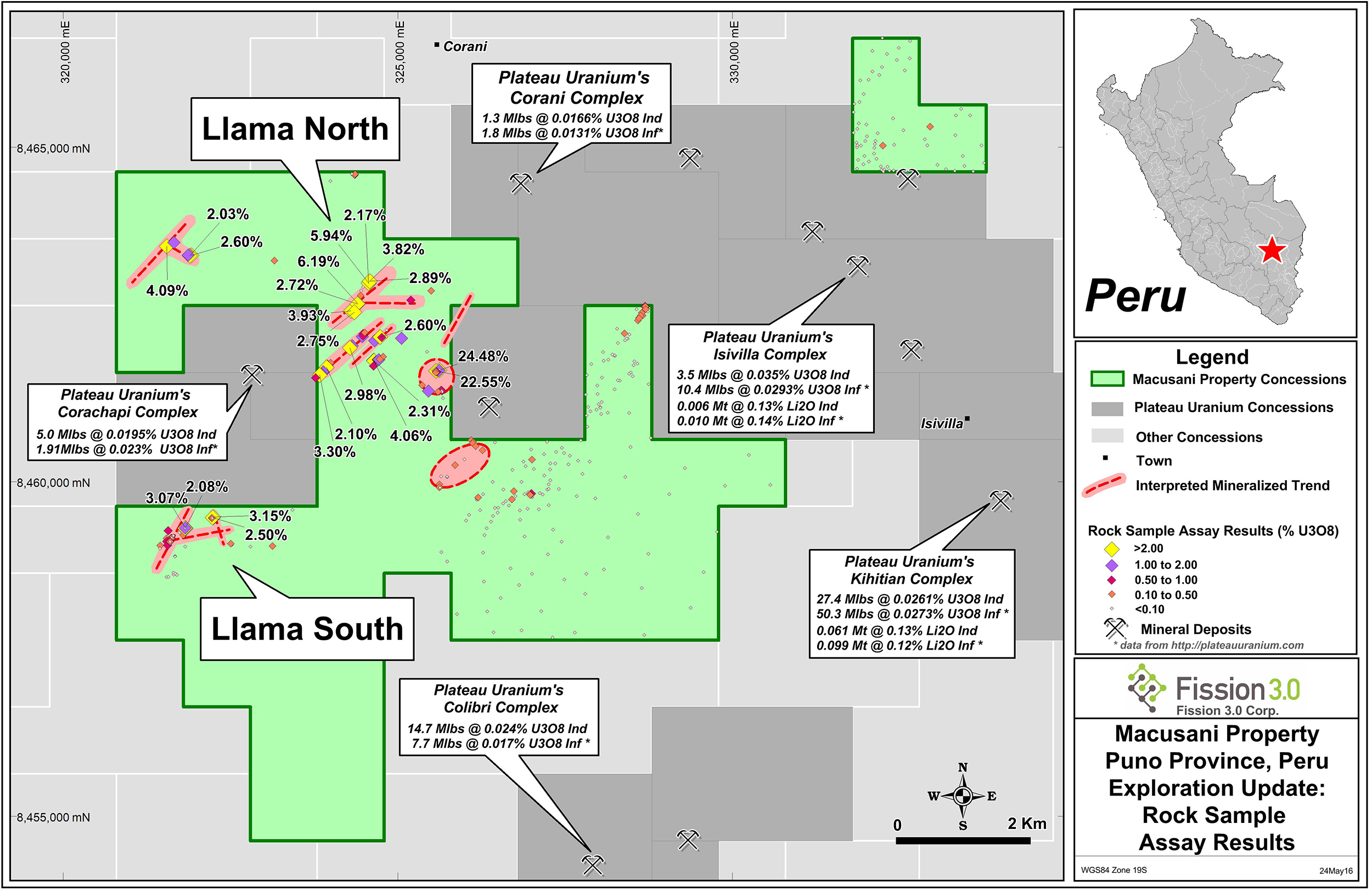

The news from Plateau showing uranium and lithium mineralization has

generated additional interest in this area. Fission 3 Corp (FUU.V or

FISOF) award winning explorers just announced a summer exploration program

on its project which is on the same corridor as Plateau Uranium's project.

The drilling will look for high grade uranium and lithium near surface.

Ross McElroy, COO, and Chief Geologist for Fission 3, commented, "This

Ross McElroy, COO, and Chief Geologist for Fission 3, commented, "This

upcoming drill program at Macusani is a very exciting next step and will

represent the first drill holes to be drilled on the property. Mapping and

prospecting has not only discovered numerous uranium in bedrock anomalies

on the Llama trend, with peaks assaying as high as 24.48% U3O8, it has

validated the model that the same mineralized trend that hosts

shallow-depth uranium and lithium resources on adjacent projects appears to

be present on our claims. Our Macusani project represents an important

project with high-grade uranium mineralization and excellent drill ready

targets in a highly prospective new uranium district in Peru, where the

infrastructure is well-established and exploration costs are low."

See the full news release by clicking on the following link:

I believe these uranium/lithium assets could be quite valuable as these two

metals are both critical for clean and carbon free energy. We could see a

major transition from fossil fuels to clean energy sources such as

nuclear and renewables.

Disclosure:

I own securities in these three featured companies Energy Fuels, Plateau,

Fission 3 and they are all paid advertising sponsors on my website. This

should be considered a conflict of interest as I could benefit from

price/volume increase and have been compensated. I have purchased

securities in open market and/or private placement. See full disclaimer and

current advertising rates by clicking on the following link:

http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/

Section 17(b) provides that:

“It shall be unlawful for any person, by the use of any means or

instruments of transportation or communication in interstate commerce or

by the use of the mails, to publish, give publicity to, or circulate any

notice, circular, advertisement, newspaper, article, letter, investment

service, or communication, which, though not purporting to offer a

security for sale, describes such security for a consideration received or

to be received, directly or indirectly, from an issuer, underwriter, or dealer,

without fully disclosing the receipt, whether past or prospective, of such

consideration and the amount thereof.”

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.

0 Responses