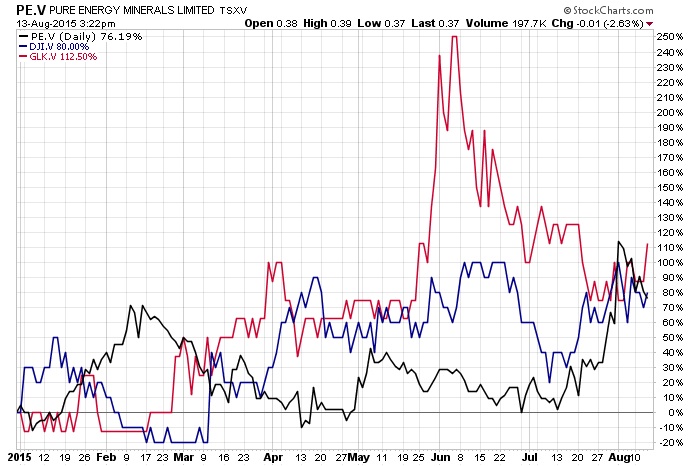

I have been following the blossoming of the lithium boom over the past few years and my readers have seen the huge amount of growth over the past two years. My readers have followed the stories of top performers such as Western Lithium (WLC.TO or WLCDF) and Pure Energy Minerals (PE.V or HMGLF). Those two stocks were champions during a brutal bear market in junior miners for good reason.

Investors are growing more convinced about the growth of electric vehicles especially with the popularity of the Tesla (TSLA) brand and enthusiastic leader Elon Musk whose goal is to put 500k electric vehicles on the road by the beginning of the next decade. Problem for Musk is there isn't enough lithium and graphite right now to fill that demand.

So Tesla has been signing deals with lithium junior miners such as Pure Energy (PE.V or HMGLF) and Bacanora to possibly secure supply and pricing. Yet graphite has been completely ignored so far. This should change soon as lithium ion batteries require much more graphite than lithium to operate.

Read more

Is There Enough Lithium and Graphite to Meet the Increasing Global Demand from Manufacturers?