Its not just me that sees the value in gold, but entire nations. The Swiss voters on November 30th will decide to back the Franc with a 20% gold reserve with a pledge never to sell its gold again. If the Swiss approve this they would have to purchase 1,500 tons of the yellow metal. This is a significant amount considering the Russians bought close to 19 tons in October. Demand in China and India is still strong as evidenced by record coin sales and numismatic premiums rising.

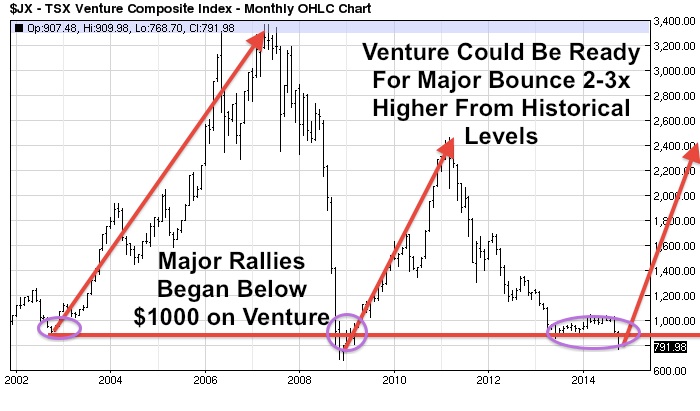

If the Swiss decide to back their currency it could be a shot heard around the world and could spark a global rush to buy physical gold and silver by other nations. Eventually, that change in psychology could affect our junior mining positions trading at pennies on the dollar to see explosive gains.

Many Central Banks around the world have a zero or negative interest policy. This expansion of fiat currency on the market has never occurred before yet investors are flocking to the US dollar in record proportions. However, smart investors are already positioning ahead of the masses. When the US dollar bubble pops and follows other currencies lower, then gold and silver may appear as the new safe haven. It is at this time where our junior miners which are trading at pennies could be trading for dollars.

Read more

Swiss Vote Could Be Catalyst For Gold To Break Above 5 Month Downtrend