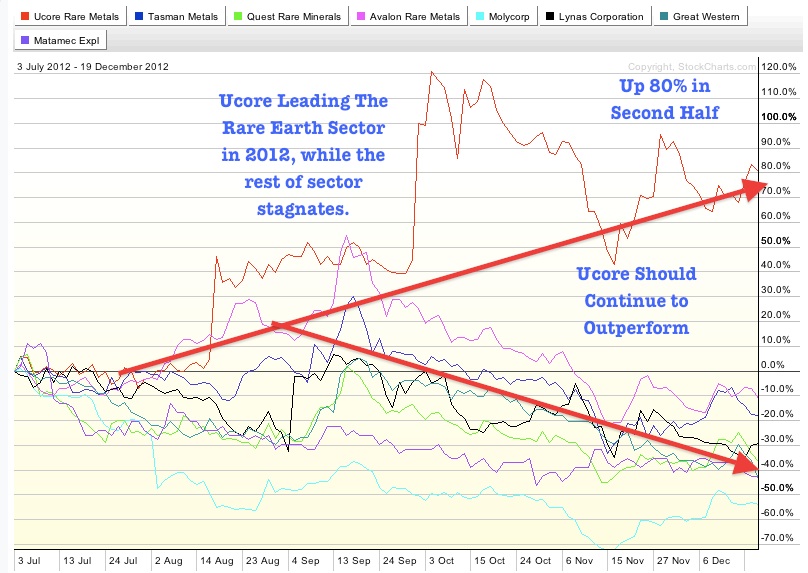

I have just returned from the Vancouver Resource Investment Conference where I presented on the critical need for many different strategic metals. The rare earth sector is beginning to attract interest as the U.S., Chinese and Japanese markets hit new 52 week highs after the changes in leadership in both countries. The rare earth/strategic metals ETF (REMX) has crossed the 200 day for the first time since 2011 and I am monitoring for a bullish golden crossover.

Read more

Is The Critical Rare Earth Sector Making a Positive Turn?