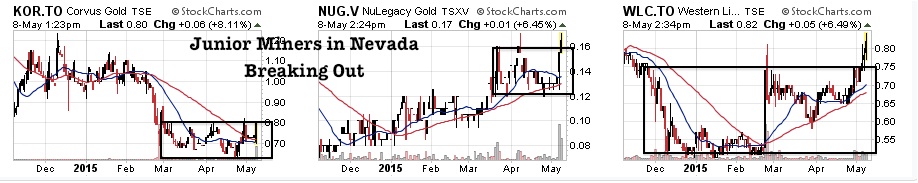

For several months I have indicated to my readers not to abandon the junior gold mining sector and to actually observe the pickup in Mergers and Acquisition activity that the bear market bottom may be near. I’ve seen M&A turn around the sector before. It was in early 2009 when I found New (NGD)Gold for subscribers after it merged with Metallica and Western Goldfields around $2. The stock ran to $14 in 2011. See the chart back from 2009.

Observe all of the M&A activity in recent months including Cayden, Soltoro, Probe, Paramount and now this week Aurico (AUQ) and Alamos (AGI) agree to a $1.5 billion merger. This could be sign of the bottom. Alamos has a lot of cash but little resource growth. I’ve talked about Aurico for months now and met with management at PDAC. Aurico has one of the best technical teams in the business with large scale production growth in Canada. Aurico has some great development properties in Canada including one of the largest, high grade and open pit gold development projects in Manitoba which they joint ventured in November 2014. The Lynn Lake Project is partnered with small cap junior gold miner.

Read more