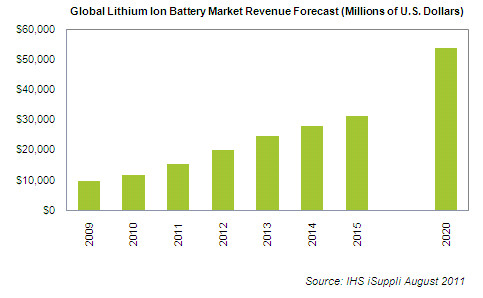

It is unbelievable to see the growing demand for lithium ion batteries in our everyday lives. Just sit in a coffee shop or ride a bus and observe the users of portable computing devices. Its not just the average Joe using lithium ion batteries and plugging in, large utilities are looking to use these batteries to support the grid and renewable energy sources.

A lot of money is going to be made in the nascent battery sector over the next five years especially right here in the United States. According to GTM Research, The US commercial battery storage market has been predicted to grow at a rate of 34% annually from 2014 – 2020.

Observe the growth of Tesla (TSLA) over the past 18 months and the new planned gigafactory in Reno, Nevada. This could be just the beginning as the electric automobile market is still in its infancy. The US is predicted to be the largest supplier of lithium ion batteries in the world over the next five years. The major concern for manufacturers is the security of supply of the raw battery pack materials most notably lithium and graphite.

A secure domestic supply of these materials to US gigafactories could reduce the price volatility which we have witnessed in the past. Battery makers must have stability as demand is growing very fast at 9% annually. Its astonishing that the US is 100% dependent on foreign graphite when we have large and stable supplies right here at home.

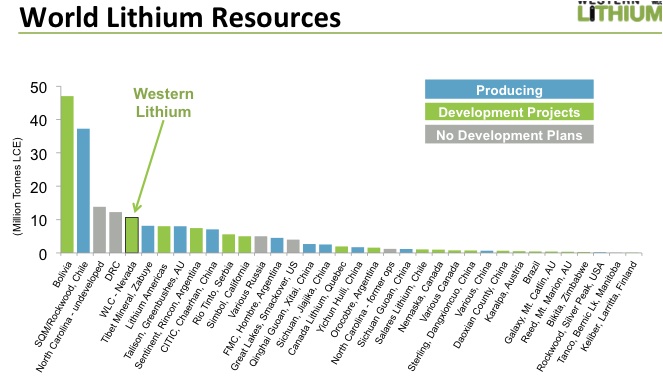

For years, I have highlighted Western Lithium (WLC.TO or WLCDF) who owns possibly the largest and lowest cost lithium asset right here in mining friendly Nevada. I’m closely monitoring for a breakout of the owner of possibly the greatest strategic lithium asset in the United States. They recently released news that they produced high purity lithium carbonate. See the full news release by clicking here.

http://www.westernlithium.com/western-lithium-produces-first-high-purity-lithium-germany/

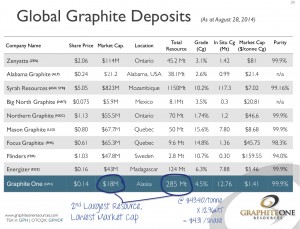

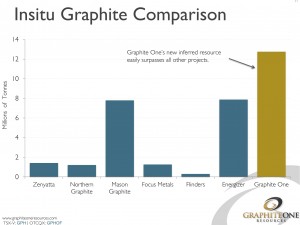

In addition, watch Graphite One (GPH.V or GPHOF) in Alaska who just released an updated mineral resource estimate of an indicated 17.95 million tonnes of 6.3% graphitic carbon (Cg) and 154.36 Million tonnes of 5.7% Cg. This news makes Graphite One the largest published graphite resource in the United States. The grade improved considerably and so did the indicated resource. There is high grade graphite at the surface and the deposit remains open. Graphite One is planning to use this resource to publish a maiden NI 43-101 Preliminary Economic Assessment on the Graphite Creek Deposit. See the full resource estimate news release by clicking here.

http://graphiteoneresources.com/news/2015/index.php?&content_id=220

I became interested in their Graphite Creek Project near Nome, Alaska. Alaska is financially supportive of mining and with the case of Ucore (UCU.V or UURAF) has pledged to finance the infrastructure capital expenses.

Investors can purchase Graphite One near all time lows and get it near the cheapest prices to date. They have put a lot of work into potentially one of the biggest large flake graphite deposits in North America which is amenable to low cost open pit scenarios.

The U.S. needs a large domestic supply and Graphite One could fulfill that demand. The company expects a busy first half of 2015. The final drill results from the 2014 program should be published in mid-February and all this will be incorporated into an updated 43-101 resource. In addition, metallurgical studies are currently being worked on with results expected by the end of the first quarter 2015.

All this data will then be incorporated into a Preliminary Economic Assessment (PEA) which should be published in the second quarter of 2015. This means if the management delivers with good drill results, an updated resource estimate, advance the metallurgy and publish a PEA then the company could see a major rerating from its current market cap of around $12.5 million.

The PEA along with support from the State of Alaska Development Fund could set Graphite One apart from its peers as a secure domestic graphite asset where 100% of current supply comes from outside its borders. It is important to note that Graphite One raised over $5 million in late 2014 and is fully funded to complete these important studies in 2015.

Graphite One may be undervalued as it owns the 2nd largest resource in its peer group yet has a ridiculously low market cap located in the US which sources all of its graphite supplies from foreigners. The share price could be bottoming as there appears to be a negative divergence between price and momentum. Graphite One is trading at a significant discount to the large financing in late 2014 at $.13.

Disclosure: I own Western Lithium, Graphite One and Ucore. They are all website sponsors. Please do your own due diligence as conflicts of interest apply.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.