Alamos/Aurico Billion Dollar Merger Shines Light On Small Cap Carlisle Gold’s Growth Pipeline

Originally Posted to Premium Subscribers 4-15-15

By Jeb Handwerger

For several months I have indicated to my readers not to abandon the junior gold mining sector and to actually observe the pickup in Mergers and Acquisition activity that the bear market bottom may be near. I’ve seen M&A turn around the sector before. It was in early 2009 when I found New (NGD)Gold for subscribers after it merged with Metallica and Western Goldfields around $2. The stock ran to $14 in 2011. See the chart back from 2009.

Observe all of the M&A activity in recent months including Cayden, Soltoro, Probe, Paramount and now this week Aurico (AUQ) and Alamos (AGI) agree to a $1.5 billion merger. This could be sign of the bottom. Alamos has a lot of cash but little resource growth.

I’ve talked about Aurico for months now and met with management at PDAC. Aurico has one of the best technical teams in the business with large scale production growth in Canada. Aurico has some great development properties in Canada including one of the largest, high grade and open pit gold development projects in Manitoba which they joint ventured in November 2014. The Lynn Lake Project is partnered with small cap junior gold miner Carlisle Gold (CGJ.TO or CGJCF).

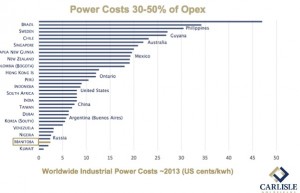

Alamos may like Aurico’s growth profile especially Lynn Lake which is a high grade and open pit mining scenario. They may believe this could be a highly profitable mine especially as it is located in mining friendly Manitoba which boasts extremely low electricity costs.

Carlisle is grossly undervalued compared to the recent PP with Aurico that was done at $.52. One could buy the shares now more than half off what Aurico paid. I recently acquired more shares at $.22 as I believe a breakout is forming. I expect to buy more as it breaks above the 200 day moving average at $.255.

Carlisle may be forming a major 4 year bottom since the Aurico deal was signed in November of 2014. Notice the higher lows. Look for a breakout above the four year downtrend to show the bulls are in charge. A break above the 200 day moving average should be observed.

It is my belief that Carlisle and/or Aurico could be offered competing bids. If not Carlisle’s Lynn Lake should be a main priority for the newly merged entity. I don’t think the merger will affect current technical development timelines and it could actually benefit Carlisle shareholders as more attention is paid to this asset. I look forward for either to Aurico/Carlisle to update us on plans at Lynn Lake this season.

If you can's watch the video you can see my recent interview with Carlisle (CGJ.TO or CGJCF) CEO Abraham Drost by clicking here...

Disclosure: I am a shareholder of Carlisle Gold and they are website sponsor. Conflicts of interest apply as I would benefit if the share price moves higher in value. Please do your own due diligence.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

To send feedback or to contact me click here…

You have permission to forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

0 Responses