All we need for a uranium bottom is follow through from major private equity funds who may be waiting in the wings ready to pounce for the following reasons. Japan has restarted two nuclear reactors. This is a major turnaround from their prior path of abandoning nuclear following once in a millennium accident at Fukushima in 2011. In addition to the 180 degree turn in Japan, China continues its record pace of building and starting nuclear power plants to move away from coal which is suffocating some of their major cities. Even the United States has started operating its first new nuclear reactor in close to three decades. All this positive news indicate demand is increasing. Because of decade low uranium prices, supply has dwindled as it is unprofitable to mine unless you are lowest cost producer. Rising demand with declining mine supply equals the potential for a price spike higher.

Read more

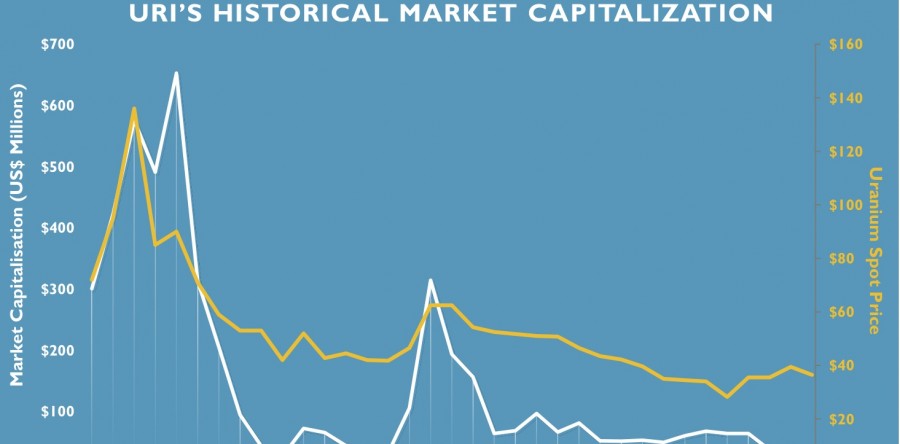

Uranium Resources (URRE) Acquires One of the Best Uranium Projects in The World