There is no doubt about it but Niocorp made investors a lot of money in 2014. It increased 400% in 2014 and was the top performer on the TSX Venture and on the OTCQX. Evan more remarkable, this occurred during one of the worst bear markets in mining history.

Niocorp (NB.TO or NIOBF) made great gains finishing a major three phase drilling program demonstrating to the investment community that Elk Creek is a world class high grade and large niobium resource.

Niocorp recently announced some economics in the Preliminary Economic Assessment (PEA). It was detailed and impressive. The 311 page report can be read by clicking here. However, the shorts took advantage to rip the top performer apart. Despite a four month correction all the way below the 200 day moving average, the stock may bounce higher as momentum is improving and as shorts begin to cover. The MACD is rising and the stock has broken above the critical 50 mark on the RSI. What might intelligent investors be reconsidering in this PEA to start once again buying Niocorp and shake out the shorts?

Investors should focus on Niocorp's Elk Creek Deposit's ability to generate cash flow on an annual basis. Niocorp’s Elk Creek Deposit should have the ability to generate cash for an extended period of time. Look at the ability to generate cash flow and the long mine life in this PEA.

These are the features which attract the roster of supporters both on the financial and technical side. Management works extremely hard on building fundamentals through technical development. They have aggressive timelines as they work much harder than the average company.

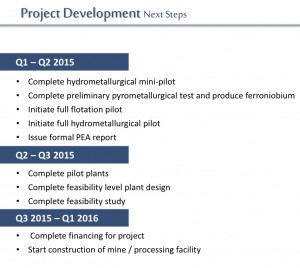

Niocorp wants to publish a Feasibility Study later this year. Management would like to see the mill operational in 2017. Niocorp has already graduated from the small cap Venture Exchange to the more prestigious TSX Big Board. The newly published PEA along with the Big Board Listing will allow them to attract larger institutional investors who will be able to support them through Feasibility and Project Financing.

Don’t forget this may be the third richest and second largest niobium resource in the world. Its located in a top mining jurisdiction with great local support. Metallurgy is starting to come together as well.

The ability to generate cash for a long period of time could attract investors looking for a good level of stability. Remember the commodity niobium is different that precious metals or oil. The pricing is much more stable, flat and predictable. Demand is rising for niobium annually as it is needed to make a higher quality steel. End Users are looking for long term stable supplies of niobium. Niocorp’s project economics show a stable price environment of cash generation that could go for three decades plus.

Niocorp is still undervalued in my opinion when looking at its North American peer the Niobec Mine which was sold for $500 million by Iamgold back in late 2014. Remember it needs at least another few hundred million for expansion. This expansion will give Niobec an extra mine life of 8 years. Niocorp’s grade is much higher and the mine life is more than four times longer.

Niocorp will not stop after this PEA as they have a busy 2015 with exciting project development timelines. They are already working on project financing utilizing the German Government Loan Guarantee Program that they are entitled to have access to through their relationship with off take partner ThyssenKrupp. Niocorp is working with the biggest banks and institutions on the equity side as well. As soon as the Feasibility is done in September, Niocorp wants to have the funding ready to go to build the project.

The deposit is located in Nebraska where the project gets overwhelming support. Nebraska would like to diversify a fraction of their economy outside of agriculture into mining. State officials and regulatory agencies have expressed their cooperation and support. Niocorp is extremely committed to every single requirement and is confident that permitting in not an issue. The mine could produce over 300 new jobs directly providing a great economic boost to the region.

See my recent interview with Niocorp CEO Mark Smith by clicking here...

Disclosure: I own Niocorp and the company was a website sponsor. Please do your own due diligence and be aware of conflicts of interest as I would benefit if the shares increase in value.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.

0 Responses