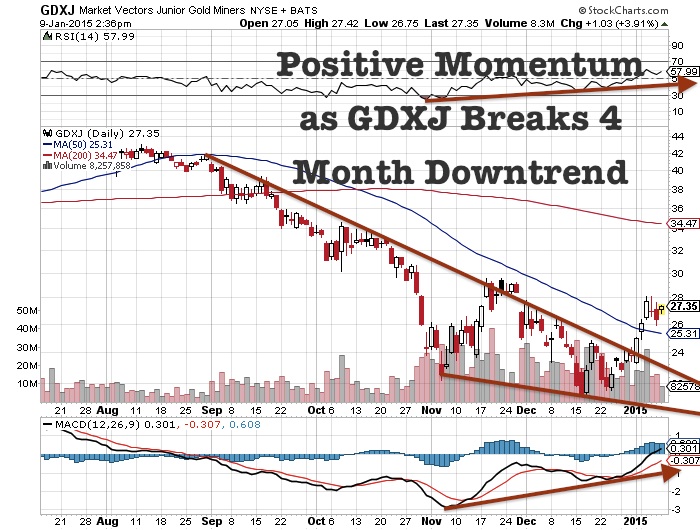

Precious metals and the junior miners are pulling back in US dollar terms after making a powerful run higher since November. Look for the 200 day moving average to provide support for gold at $1255.

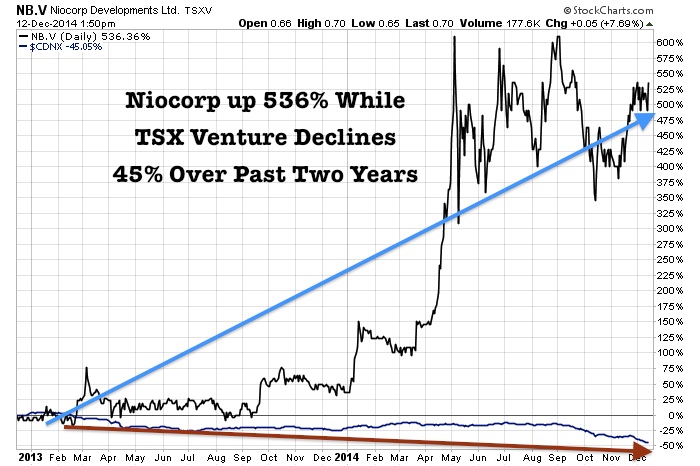

Last week, I highlighted a junior gold miner in Nevada and believed that a breakout would occur from the ten month downtrend. I believed that late 2014 presented an excellent opportunity near all time lows. Recently, the stock has broken out above the downtrend and 200 day moving average on a major deal with Newmont in which they acquired 1,600 acres of mining claims in mining friendly Nevada.

Read more

Junior Gold Miner In Nevada Breaks Above Downtrend After Recent Land Deal with Newmont