In a recent landslide election, Republicans took back control of the Senate and House. President Obama's approval rating is very low. Although there a few making money in the stock market, the majority of the American people are fed up with close to 100 million people not working. Welfare and entitlement spending is out of control. The debt is still soaring close to $20 trillion and the dollar is rising making it even harder for politicians and banks to avoid default. Somehow irrationally despite billions of dollars being printed under the guise of QE, the US dollar is rising. The question I ask is how long do you really believe this dead cat bounce in the US dollar will last?

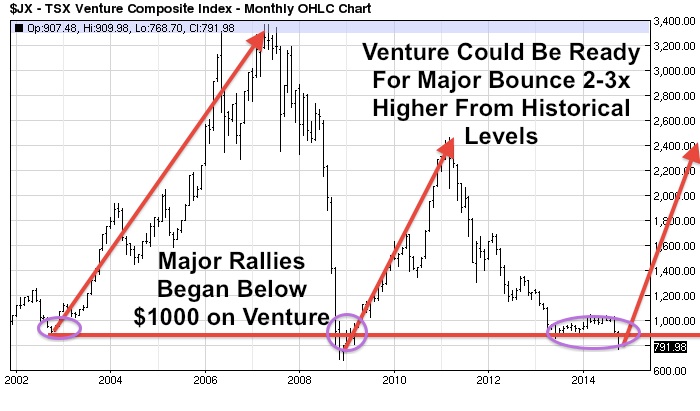

It may be just a bounce in a long term downtrend and is only relative to the other fiat currencies in fast decline. Smart investors should be accumulating gold and silver coins and high quality junior mining stocks trading now at historic lows. It should be noted that coin sales are picking up especially mint grade numismatics.

Read more

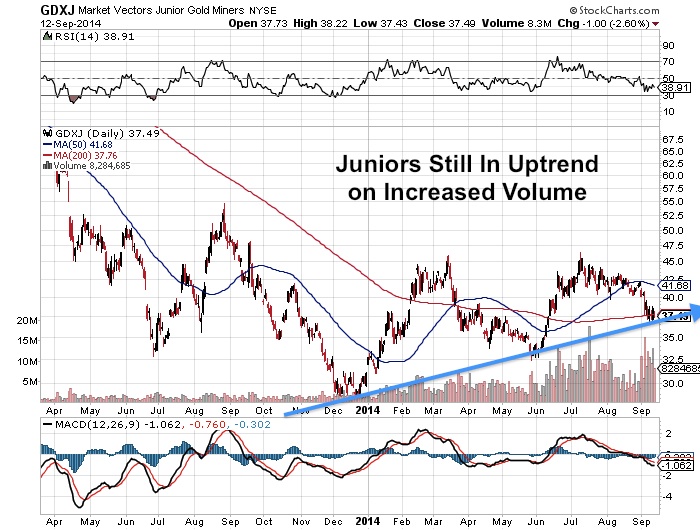

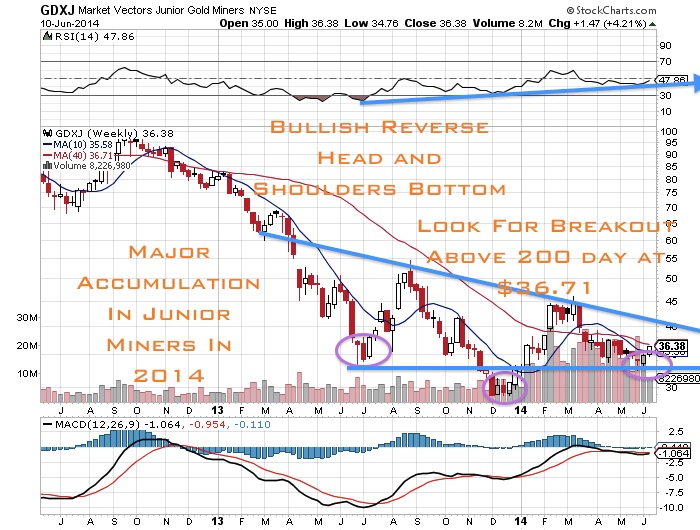

Record Volume In GDXJ Junior Gold Miners Could Indicate a Bottom