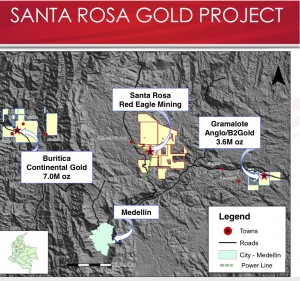

I recently took a trip to Medellin, Colombia to visit Red Eagle’s (RD.V or RDEMF) Flagship Santa Rosa Project. On the trip were analysts from major financial institutions.

Red Eagle is only weeks away from publishing a Bankable Feasibility Study on a project which I believe will come into production in the next 18 months.

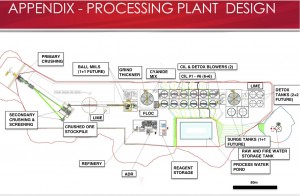

The 320 sq. km Santa Rosa Gold Project in Antioquia has already produced a Preliminary Economic Assessment (PEA) that shows the potential for production of around 50k ounces per year with low cash costs around $620 an ounce.

This means that possibly within 18 months Red Eagle has the ability to cash flow over $60 million of profit if gold stays around $1300 an ounce. Red Eagle flies above the others as the project has one of the best economic profiles in the junior mining business.

Red Eagle has one of the highest internal rate of returns in the junior mining business at 47% with a payback at 1.4 years. It could be the first permitted modern major mine in Colombia.

The reason it is the front runner in my book is that it has broad community support, excellent infrastructure and major cooperation with the local community especially the Universidad de Antioquia and the Fundacion Universitaria Catolica del Norte who assisted with the development of the Environmental Impact Study.

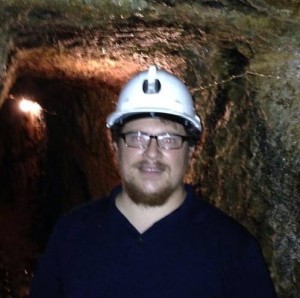

I met with the Colombian team and the Chief Operating Officer Bob Bell who has built close to a dozen mines. The Colombian Management was top notch and hope for the final permit in the fourth quarter.

On my visit to the mine I felt extremely safe and observed the access to infrastructure and the broad based community support. There is no illegal mining on the property or social issues like other mines in the neighborhood. Red Eagle has come a long way in only 3 years when they drilled the first discovery hole and management is ready to build a major mine.

Over $55 million has been invested in the project to bring it to this point . With a small market cap of around $20 million, Red Eagle may be a takeout target. That is why Red Eagle’s board just adopted a shareholder rights plan to protect against a hostile takeover at these levels.

It may be a no brainer for a buyer. The project is located only an hour and half drive from Medellin, Colombia, the economics are excellent with a PEA which showed low capital costs estimated at $84 million. At $1300 gold, the post tax NPV is $113 million with a high IRR of 37% and a payback of 1.4 years.

New investors get over 45,000m of drilling, two resource estimates, a Preliminary Economic Assessment (PEA), Environmental Impact Assessment and a soon to be published BFS for literally pennies on a dollar.

With only 74 million shares outstanding, a current cash position of $7 million, a key 19.9% shareholder like Liberty Metals and Mining and top notch management which owns around 12%, I believe Red Eagle could possibly triple from current levels as the BFS is published and as they receive the final mining permits which could all happen by the end of the fourth quarter.

I recently initiated a position and would try to get in below $.33 which was the last financing price. Look for a breakout above $.30 on good volume.

Red Eagle's 320 sq. km Santa Rosa Project should be a simple project to get into production with a lower risk profile and high IRR of around 47%. The metallurgy is simple with 93% recoveries. Cash costs should be around $620 per ounce of gold.

The management team is five star led by CEO Ian Slater a managing partner at Arthur Andersen and Ernst and Young's mining division. The COO is Bob Bell who has built and developed close to a dozen mines including most recently Dundee's Chelopech Mine. The Board of Directors is impressive with heavy hitters such as Ken Cunningham, Rob Pease and Jeff Mason.

In conclusion, I believe Red Eagle is a bargain opportunity under a $25 million market cap for the following reasons.

1)Asset is technically simple. Simple type of mining and excellent metallurgy. Company is advancing from PEA to BFS due to the simplicity of the project. Near term production in 2016.

2)Economic with low cash costs of around $620 per ounce. High pre tax IRR of 47%.

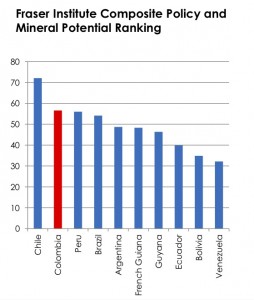

3)Low permitting, mining and financial risk. Colombia is ranked #2 jurisdiction in South America right after Chile according to the Fraser Institute. Security has improved dramatically over the past decade.

4)Long term strategic shareholder Liberty Metals which owns 19.9% minimizes financial risk. Management has skin in the game and own around 12%.

It is important to remember in the previous bull market cycles in junior gold miners we saw some hefty premiums paid for companies like Ventana, Galway and Calvista. Currently the majors such as Anglogold, Tech, Iamgold, Agnico Eagle among others are interested in high quality projects, which are economic and have the best chances to get into production.

I believe Red Eagle's Santa Rosa may be one of the top ones on the list for a major or a mid tier producer looking for a high quality, simple and economic asset. That is why Red Eagle may be adopting this recent shareholders rights plan.

Click here to see my recent interview with Red Eagle CEO Ian Slater. Ian has been in the mining business for over 20 years, is a chartered accountant and was the Managing Partner at Ernst and Young’s and Arthur Andersen’s Mining Division.

For more information on Red Eagle Mining contact James Beesley at 604-682-4600 or 778-389-7715

Disclosure: Author owns Red Eagle and the company is a website sponsor.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend.

To send feedback or to contact me click here...