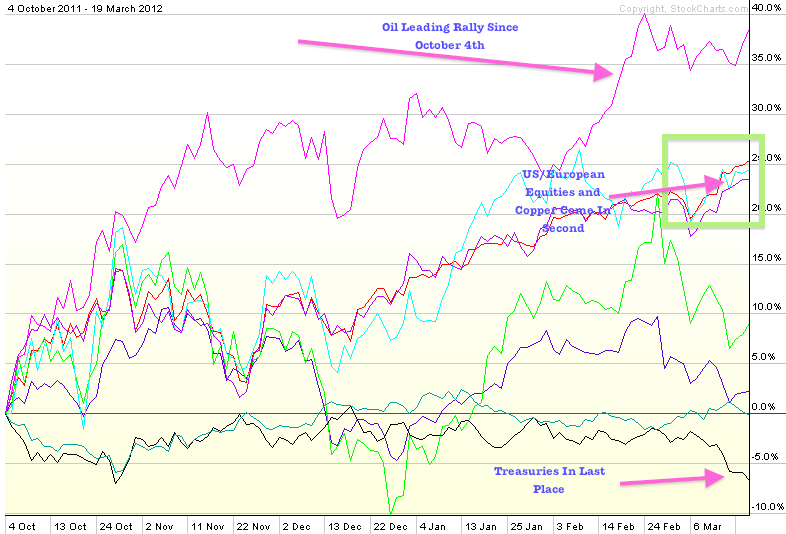

Junior mining stocks are at record oversold levels, rarely presented to investors.

This may be representing a historic bargain basement buying opportunity. Long term

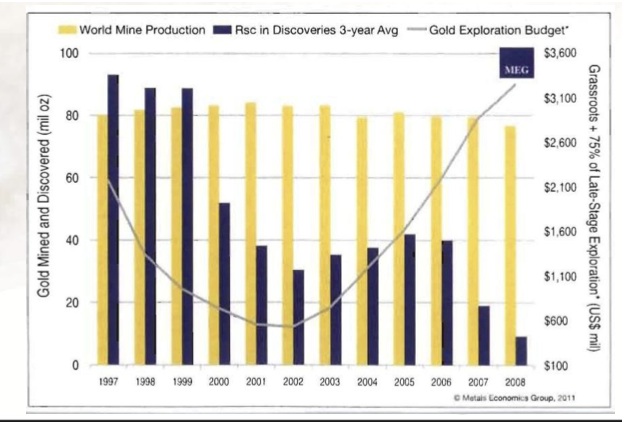

mining investors are aware that the rate of new gold discoveries is

decreasing despite record exploration expenditures from the majors.

Enter center stage, a rising project generator, who uncovers new greenfield exploration targets...

Read more

Gold Price Will Continue Higher as Rate Of New Discoveries Decreases