Middle East: 2012's Black Swan

For many centuries, the Middle East has been a simmering cauldron that now may be coming to a boil. Across the centuries we have witnessed world events being influenced by what occurs in this geopolitical arena.

We have only to witness Abel and Cain, Esau and Jacob, Ishmael and Isaac, among others. Even today, these classic blood feuds continues across the centuries. They extend as far as Egypt,Darfour, Kashmir, Somalia, China and most recently Mali where there are many major gold mining companies operating.

This brings us to this moment. We must keep an eagle’s eye on the Iran-Israel situation. The main issue is that Tehran must sense that this moment presents them with a critical window of opportunity. While The West is struggling to make some sense of a troublesome economic morass, Iran is working 24/7 to come up with a working nuclear warhead.

Oil has rallied off lows in October for six straight months outpacing equities, treasuries and precious metals. It may be receiving a premium due to the Middle Eastern turmoil and may be forecasting an oil spike. The $115 mark is a key psychological area which is about to be reached again and a breakout could cause a spike to $150. Are investors positioning for a black swan event in the Middle East?

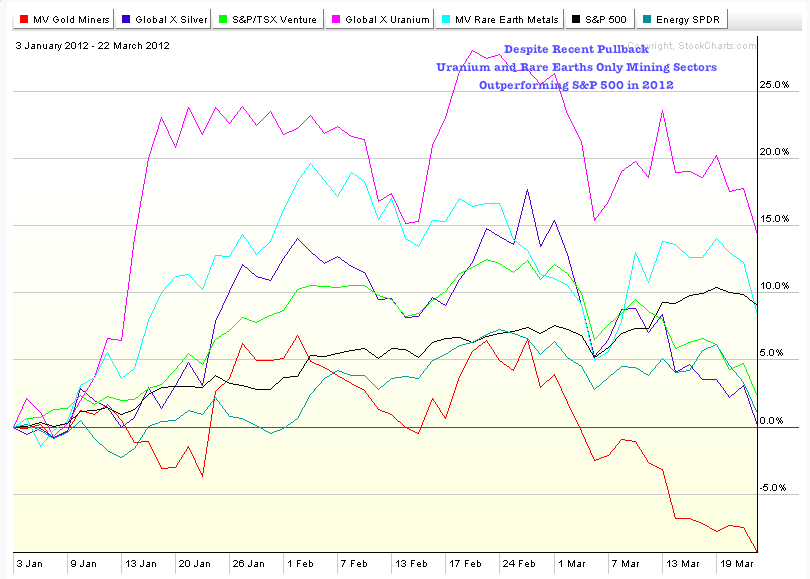

Uranium and Rare Earth Miners Outperforming In 2012

It should be emphasized here that the uranium and rare earth miners have been the only two mining sectors since the beginning of 2012 to outperform the S&P 500. Both sectors have a very common attribute, these metals are crucial for energy independence and are already in a supply shortfall. A spike in oil could be a major catalyst in the price of uranium and rare earths which are the essential ingredients for clean energy.

Understand that the International Atomic Energy Administration (IAEA) published a report to this effect back in 2011 which we highlighted to subscribers. Heretofore, this arm of the United Nations has been loathe to publicize such data. Therefore, it is surprising that an arm of the United Nations should be condemnatory of the Mullahs. One could reasonably conclude that when the U.N. issues such a cautionary statement, it behooves us to listen.

Gold Stock Trades feels that the hour is late and attention must be paid. While The West is weak economically and has its own basket of see-saw rallies one day and cardiac declines the next day that are seized on by the sharks of the media for the day’s news. Therein lies the difference between the fiscal feud in The West and the religious feud in The Middle East.

Take note that the average age in Iran is below 28 years. Remember that the young people recently demonstrating in Tehran might well have succeeded in overthrowing the old fundamentalist regime, but for the silence of The West including the United States. The aging Ayatollahs realize that they must soon make their move while Europe and the U.S. are stuck in their economic quagmires.

Our position in uranium and rare earths takes time to germinate and reach fruition. At the moment they may be out of favor as the herd piles into overbought “blue chips” not realizing that rare earths and uranium have bottomed and are actually outperforming.

The distraction of the daily markets are taken as temporary diversions as we patiently await rewarding paydays. Imagine the effect that the closing of the Strait of Hormuz might have on the global financial markets and the need for energy independence. Therein lies the spark to evoke the spike in our strategic metal mining selections.

As for The West it is a matter of survival so they must also consider preemptive moves sooner rather than later, which includes rebuilding national stockpiles of uranium ore and critical rare earth metals. We are witnessing warnings that there are sleeper cells throughout the European and U.S. metropolitan cities.

What do all these stratagems mean for GST subscribers? Gold Stock Trades believes that the Middle East kettle may boil over which may ignite the uranium and rare earth resource sectors in a Vesuvian spike.

Tasman and Corvus Showing Strength In Weak Market

Recently the boards were colored crimson. Only two stocks stood out in the green. It was Corvus Gold and Tasman Metals. Corvus made a high grade discovery on its North Bullfrog Project. Tasman announced an extremely robust PEA, with a lot of revenue from dysprosium an element vital to modern industrial nations and at risk of a supply shortfall.

For sure the majors and sovereign governments including the Chinese are sitting on large amounts of cash and treasuries and are in trouble. They must rapidly look for promising uranium and heavy rare earth miners. We feel confident that our current list has sufficient takeover candidates when the big boys (Barrick, Goldcorp, Agnico Eagle, Cameco, Molycorp) go shopping.

Gold and Silver is undergoing a retrenchment which some observers consider a bearish signal, but we consider a secondary buying opportunity. Notice in 2011, that base metals involved in industry were grossly underperforming gold. Should a spike occur in the Middle East all of these boats might rise in a tidal like move especially critical energy metals such as uranium and rare earths. Remember that the mills of our miners grind exceedingly slow and fine except when exogenous developments such as a surprise eruption in the Middle East. The tide may turn to truly value the miners which uncharacteristically has underperformed bullion. Remember for most of this past decade and over the long term the miners will continue outperforming.

Charts on gold and silver exhibit what is called by some a “reverse head and shoulders” which is a bottoming formation. The 200 day moving average is still sloping higher maintaining the long term uptrend. Gold and Silver are currently testing support at $1600 gold and $30 silver. These consolidations are characteristic especially after such powerful upmoves in 2010 and 2011. It may now be the uranium and rare earths turn to play catch up.

The recent end of 2011 lows have held and we may see a reversal off of the lows in the miners. At this time gold, silver and the miners may be the most oversold it has been since the 2008 credit crisis which proved to be an excellent buying opportunity. We believe the charts are basing and preparing for its next move higher which may be the breakout move. We may be witnessing the shakeout before the breakout.

This low volume rally in equities and uncharacteristic pullback in the miners is characteristic of a fear driven market that does not follow traditional methods of fundamental analysis. Eventually all the miners will break out of this zig-zag pattern and outpace equities as they have done over the past decade.

________________________________________________________________________

Look For China To Acquire Junior Uranium Miners

Athabasca Uranium Working On Major Alteration At Keefe Lake

Disclosure: Long CORVF,ATURF and TAS