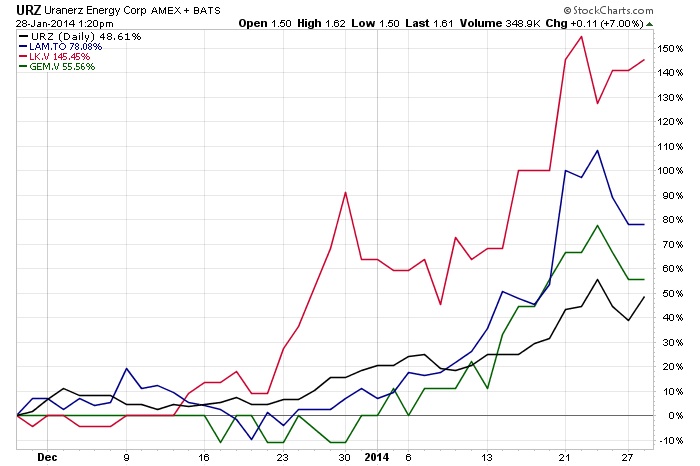

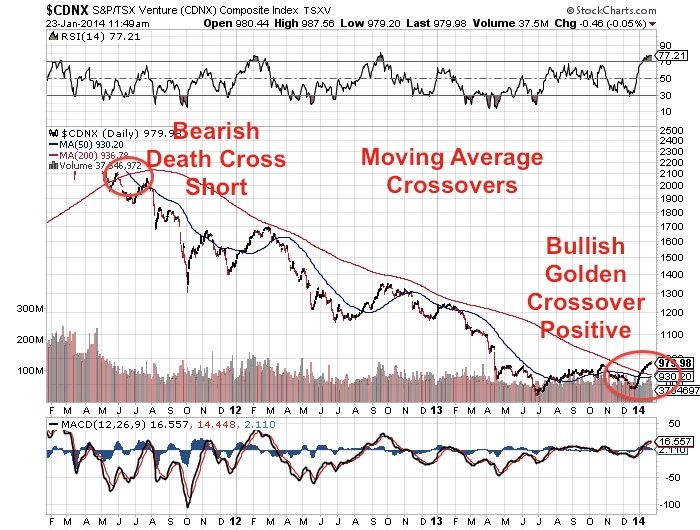

No other rare earth company I know of has been given the local support like this one has received from the State of Alaska. Shareholders and management are very thankful to the state as the value of this asset should continue to soar on this historic and unprecedented local geopolitical support. This is the first time that I have seen a state actually propose financial support to a rare earth mine. A heavy rare earth project like this could be bring huge economic opportunities and jobs to Southeast Alaska and restore U.S. independence. This may signify that this rare earth miner has regained itself as the U.S. leader in the heavy rare earth race. Look for a bullish golden crossover after this historic and high volume technical breakout.

Read more

Junior Rare Earth Miner Soars On State of Alaska Support