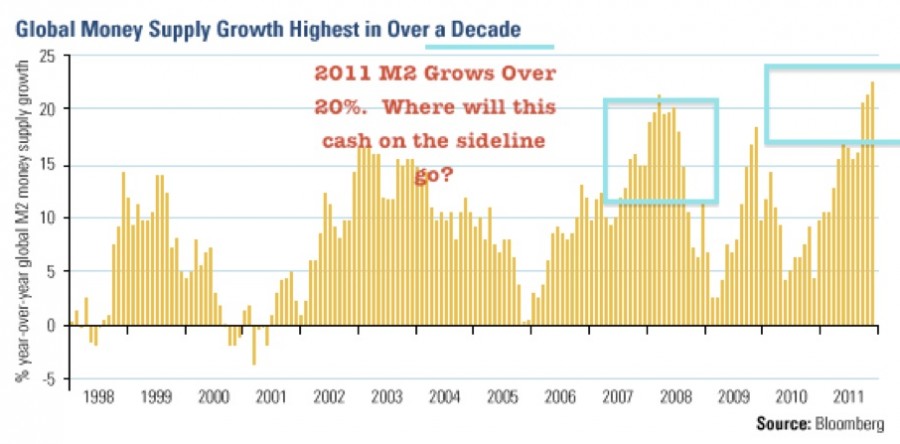

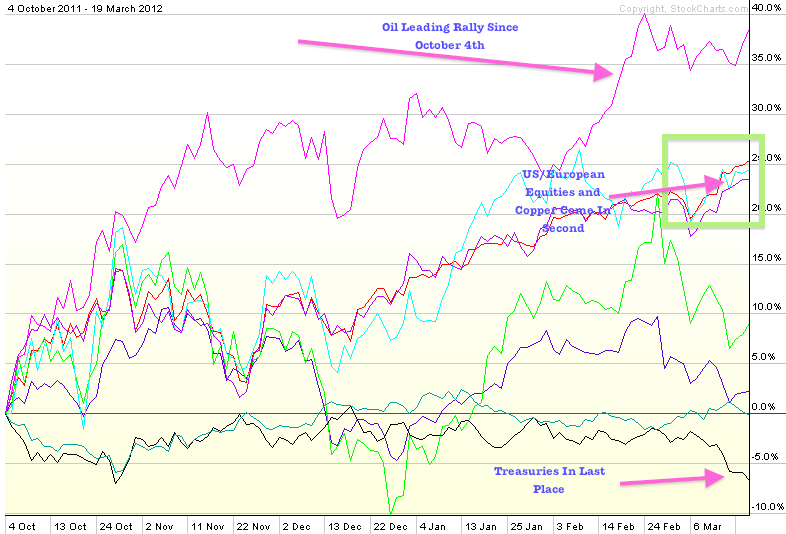

For many months, I have alerted you that capital will flow from bonds/equities/fiat currencies into precious metals, commodities and junior mining stocks as we begin to enter the inflationary cycle which historically follows deflations. Central Banks are fighting economic contractions with quantitative easing which they are reluctant to end. Our metal and mining sectors have been leading the markets over the past three months. Currencies are declining rapidly most notably in India, Turkey and Brazil. Hyper-inflation may start rearing its ugly head like I predicted many months ago. The U.S. dollar is also looking like it is on the brink of a major decline to break 2012 lows as it breaks down from a bearish rising wedge.

Read more

Look For Rebound In Undervalued Producing Coal Miners