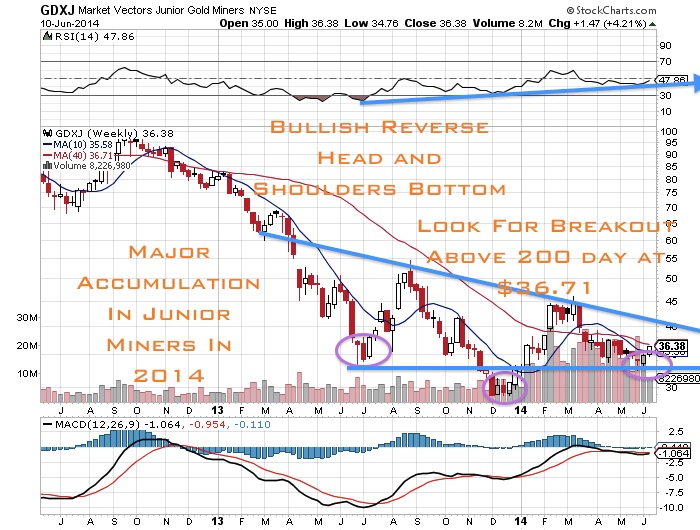

At the end of 2013, I predicted the junior gold (GDXJ) and silver miners (SIL) would outperform the S&P500 in 2014. I was right so far in 2014. THe GDXJ is up over 36% on the year while the S&P500 is up under 5%. However, one of the junior gold miners that I predicted would be a major winner back in December of 2013 has far outpaced the mining and overall market indices by a wide margin. The small junior miner is up over 200% in 2014. Find out which one and why.

Read more

Why This Junior Gold Miner in Nevada Soared 200% in 2014