Gold and silver mining stocks are going through a pullback after jumping considerably in the first quarter of 2014. Despite the correction in gold mining equities, I have searched for undervalued gold situations with large deposits and the financing to advance the project. Eventually, the junior gold and silver stocks will rebound magnificently from these historic oversold levels.

I recently became aware of Mega Precious Metals (MGP.V) who owns a 3.5 million ounce gold deposit in Manitoba, Canada, which is a very supportive and stable jurisdiction. Manitoba has one of the cheapest power rates in the Americas.

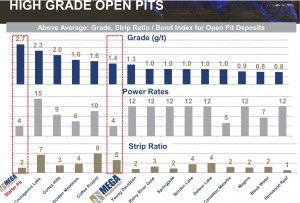

In addition, Mega has a high grade starter pit at 2.7 g/t with high grade tungsten as a potentially economic byproduct. Mega has attracted the major institutional interest of Pacific Roads who could fund Mega up to $40 million and through feasibility.

This is important for Mega as many mining companies do not have access to capital to advance projects in these tough economic times. Between Pacific Roads, Pinetree Capital and Dundee the company is controlled around 50% by institutions.

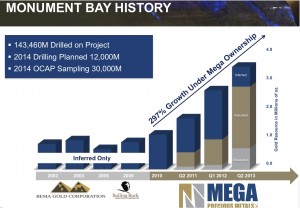

Mega's Monument Bay Project is large with 3.6 million ounces that covers only 8 kms of greater than 140 kms of gold/tungsten bearing structures. Mega has drilled over 143,460 M on the project and has grown the deposit exponentially since 2010. Despite this astonishing increase in intrinsic value the share price is still trading near three year lows below one-third of its book value.

An additional 12,000 M are planned this year. Despite the great rise in value of this asset over the past four years to over 3.6 million ounces of gold, the stock's market cap is hovering around $16 million.

Despite having a higher grade, lower strip ratio and lower power rates Mega Precious Metals (MGP.V) is trading at a bargain compared to its peers. It has a deep pocketed institutional partner funding advancement.

As an additional kicker that is completely overlooked by the market, Mega owns the North Madsen and Headway Project which is adjacent to the Madsen Mine which was owned by Claude Resources and acquired by Laurentian Goldfields in the heart of the famous Red Lake District. Mega has a 1.3 million ounce resource that is near surface.

Mega is going to have a very active 2014 with over 12,000 M being drilled. They just released news on metallurgy which was very positive.

I thought that the break of the long term downtrend line this March at $.20 could be the turning point. However, Mega has pulled back to form a possible reverse head and shoulders bottom. I think that the RSI and MACD are forecasting a potential bottom. Look for a breakout above $.25 to confirm that the three year downtrend has ended.

Check out my recent interview with the CEO Glen Kuntz who started his career two decades ago working on Monument Bay with Noranda Exploration. Noranda was eventually acquired by Falconbridge which was acquired by Xstrata.

Please review the Mega website at www.megapmi.com

For further information, please contact:

Mega Precious Metals Inc.

Glen Kuntz, P.Geo.

President, Chief Executive Officer & Director

O: 807-766-3380

TF: 877-592-3380

Disclosure: Author owns Mega and company is a website sponsor.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...