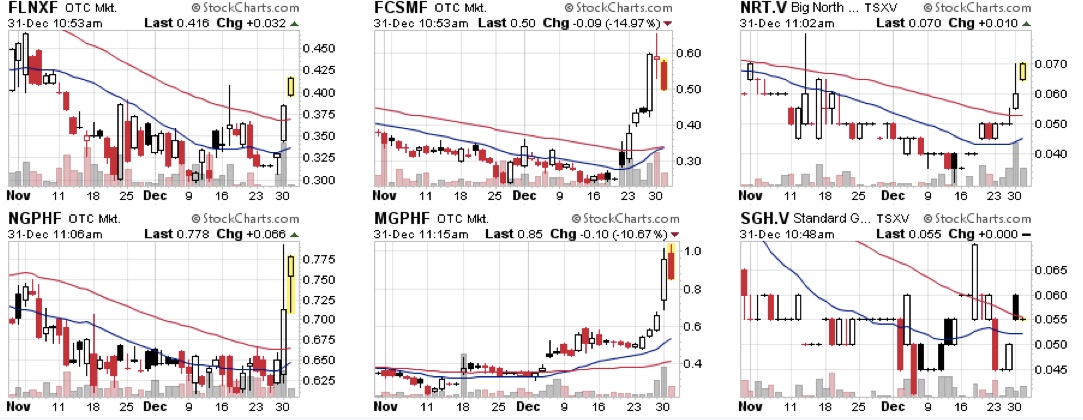

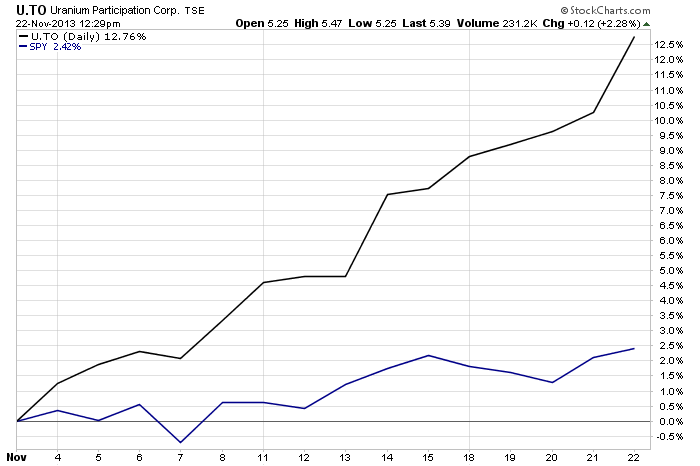

The TSX Venture is making a bullish move above the 200 day moving average. This is the first weekly move above this key technical level in more than three years. This may signal that the vicious downtrend in the resource sector may be ending.Watch uranium as a bellwether for the revival of the sector. The Fukushima Disaster really was the major event to cause panic at the top in 2011. A bullish golden crossover of the 50 and 200 day moving average in the uranium price may be signaling a bullish turnaround in the entire commodity complex. This is the uranium prices third attempt at a breakout. The third time is usually a charm in the financial markets. Look for a breakout on Uranium Participation Corp at $5.77.

Read more

TSX Venture Moves Above 200 Day Moving Average For First Time In Three Years