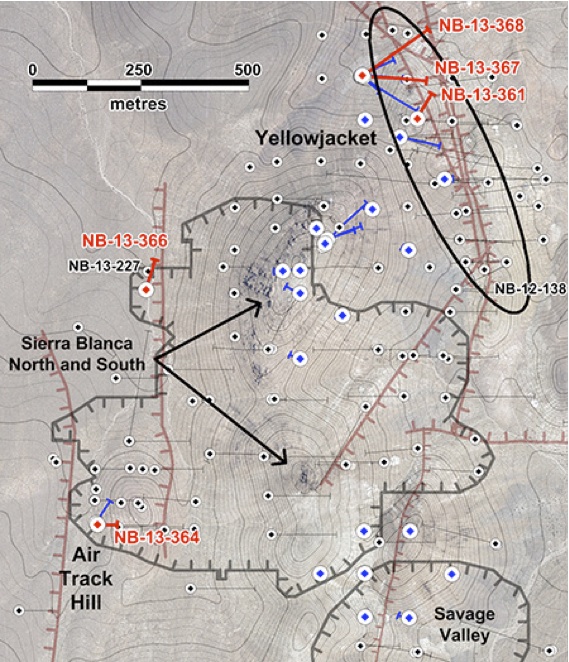

I recently spoke to Bob Kramer last Wednesday and he was so excited about the drilling program this summer. Unfortunately, Bob Kramer will never be able to see the results of what he worked so hard to achieve these past few months as he suddenly passed away over the weekend. Bob worked so hard over the past few months to raise the capital from a strategic investor to fund this year's drilling program. Family came first to Bob. I would like to send my deepest condolences to Bob Kramer's family and all his loved ones.In January of 2014, I worked with Bob up in Vancouver to create the top 10 reasons to invest in Canamex Resources as I believed this should go in the front of the presentation. Here are the reasons Bob and I both came up with:

Read more

Top 10 Reason To Invest In This Junior Gold Miner in Nevada