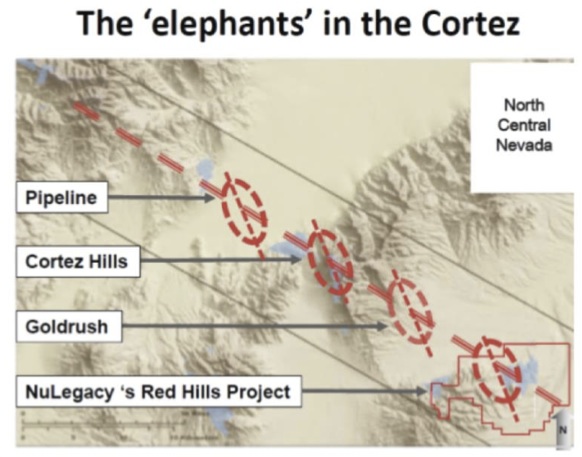

Production and cash cost numbers from the mines of the Cortez trend are extraordinary. The carlin-type gold systems in the Cortez Trend are very large, relatively high grade (2-4+ grams), near surface; therefore open pit-able,oxidation is fairly deep, so processing of the ore is relatively inexpensive. Plus the fact that Nevada generally is a great place to mine, great infrastructure; paved roads, electricity,trained work force; truck drivers to engineers to geologists,tax rates are good, permitting, although rigorous, is straight forward. Nevada is a great place to operate a mine profitably even at these lower gold prices.

Read more