Now for the first time in many years I am getting notes from top traders that they are buying industry bellwethers Barrick $ABX and Newmont $NEM as they have reduced debt, sold off marginal assets and are starting to increase free cash flow especially with higher gold prices.

Read more

Junior Mining Stocks: Buy Fur Coats During A Summer Heat Wave

Let's look at three current positions that I have recently featured. Since early May some of our featured companies are up exponential. This has come at a time when frankly the junior mining sector has sucked. In some ways its almost as bad as the end of 2015.

Read more

Multi-Year Breakout in Gold at $1400 Could Boost Junior Miners

“We see a breakout at $1,400 in gold, which could mean new multiyear highs,” said Jeb Handwerger, editor of GoldStockTrades.com, which offers a newsletter focusing on mining exploration companies. Gold futures haven’t topped $1,400 since 2013.

A decline in the value of the U.S. dollar has recently helped boost dollar-denominated prices of gold, but Handwerger pointed out that “many investors have been diverted away from mining into much more speculative areas like blockchain and cannabis.”

“Even investment conferences and newsletter writers who were once gold bugs are now cryptocurrency gurus,” and this is very similar to 1999 when gold bulls became dot-com gurus,” he said. “Eventually, we will have another gold rush possibly even bigger than the late 70s but possibly more like the 30s.”

Read more

Silver Stocks May Be Cheapest Opportunity In Decade

Gold miners have kept in line with gold bullion and stocks so far this year. Copper, zinc and palladium have outperformed both stocks and gold. However, silver and silver stocks have lagged behind but I believe they could not only play catch up but they could far surpass the gains of these other metals as their is a record short that may soon have to cover if the US dollar finally breaks down. Silver may be the cheapest and best opportunity in the market right now from a value perspective. If you notice the silver to gold ratio has not reached this high since 2008 and 2002.

Read more

Medical Developer Believes Device Could Screen for Deadly Strokes and Save Lives

Usually I am focused on natural resource stocks and mining as I like the fact that the companies are backed by real assets in the ground that can be verified with NI 43-101 reports. However, there are times when some new small cap situations are presented in other sectors that are unique and exciting as the potential can't be denied.

Right now in the US a person suffers a stroke every 40 seconds. It is the leading cause of disability and 3rd leading cause of death in this country with close to 800k strokes annually. Its costing our healthcare system over $70 billion in 2010 and this is expected to triple over the next decade.

There must be a better way and I think I may have found a new situation that could possibly help stem this stroke crisis. Carotid arterial stenosis or plaque buildup is a leading cause of strokes. A little company which is barely a month or two old publicly has a medical device with patents that measures infrasound waves of the blood flow through the carotid artery and analyzes the blockages.

Read more

Gold and Silver Pulling Back To Support, Could Fed Meeting Next Week Boost Junior Miners?

It appears that gold broke its downtrend and 200 Day Moving Average in early 2016 forming a bullish golden crossover in February. Then in June gold broke 2 year highs and has since consolidated to the breakout point at $1300. Its quite normal after making such bullish breakouts to hold at that level before the next leg higher. This summer gold has taken a breather pulling back to uptrend support. It may still base until the Fed decision next week providing what may be looked back upon as a secondary opportunity for those who missed the Brexit breakout in June.\

Gold and silver both have rising 50 and 200 day moving averages which are bullish showing an upward trend. Notice rallies have been on increasing volume showing possible accumulation. It broke out into new 2 year highs in June following Brexit and has since consolidated returning to the breakout point. This past week it made a weekly bullish engulfing pattern which may signal a short term reversal to the breakout technical target of $23.50. The move may accelerate higher after the Fed announcement next week.

Read more

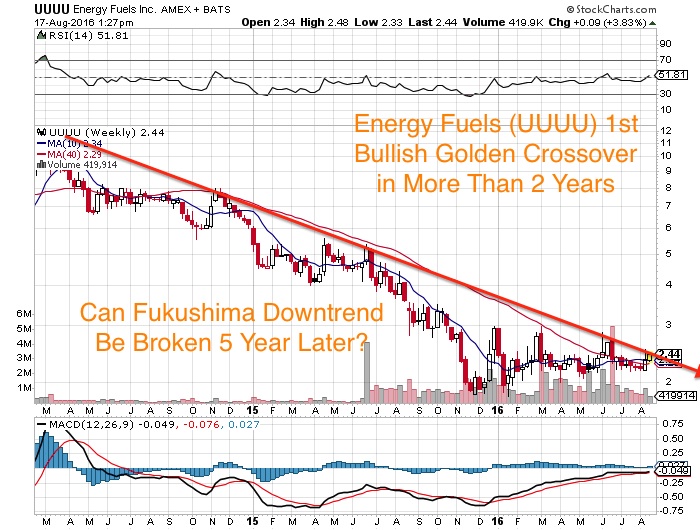

Uranium Market Bottoming Five Years After Fukushima as World Heats Up From Carbon Emissions

We should invest in this forgotten sector when it is dirt cheap and in the midst of a bust as the long term forecast for nuclear is very strong. Climate change and global warming concerns will not go away and I believe America will continue to build and update its nuclear fleet over the next 5-10 years. Investors may wise up to this soon that nuclear is not on its way out, but waiting for a new beginning. The next nuclear renaissance will be with next generation small modular reactors in the battle to fight climate change.

Read more

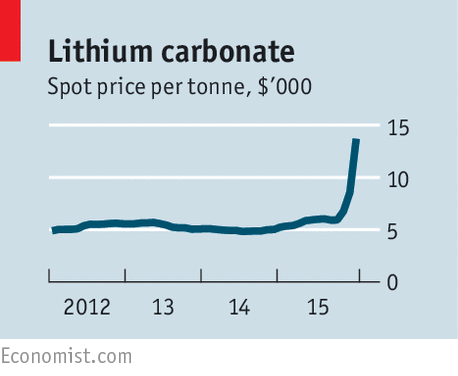

Investment Banks Excited Over Future of Electric Vehicles Using Lithium Ion Batteries

Important developments are taking place in the lithium ion battery sector. For years we highlighted lithium as the new gasoline. I highlighted in this article entitled “Lithium-Ion Batteries becoming the fuel of the future” written over two years ago that demand could soar for electric vehicles. Now two years later even the big player investment banks like Goldman Sachs are finally entering the sector.

Read more

Power Up Your Investment Portfolio with Solar Energy

For years I have been researching clean energy investments in lithium ion batteries, nuclear, rare earths and renewables. However, I haven't made a solar investment in years until a few months ago. Over the years, I have been a skeptic on solar as I felt the cell technology was not yet advanced to be competitive economically.

This past year may have been a turning point in solar investments and the coming 3-5 years could see exceptional growth especially with the advancement in the Lithium-Ion Battery and Power Storage. Solar should continue growing while natural gas and coal go extinct like the dinosaurs. California, Arizona and Nevada are definitely leaders increasing solar capacity, hopefully my home state of Sunny Florida will increase their usage.

Read more

Precious Metals and US Treasuries Seen as Safe Haven as Oil and Stocks Crash in 2016

It is important to study the beginning of trading in January as major pools of capital tend to re-position around this time for the new year 2016. So far this year it has been ugly, one of the worst starts in history. Oil is crashing below $30 down over 20% year to date. The Nasdaq and Russell 2000 are already down more than 10% year to date. Mostly all markets are in the red except precious metals and treasuries.

Read more