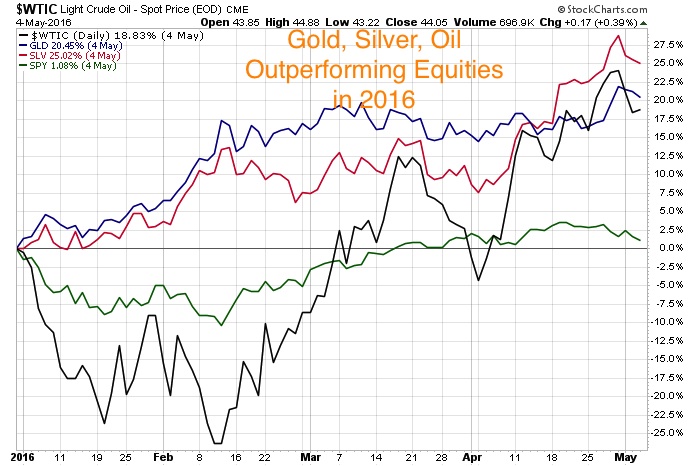

Gold miners have kept in line with gold bullion and stocks so far this year. Copper, zinc and palladium have outperformed both stocks and gold. However, silver and silver stocks have lagged behind but I believe they could not only play catch up but they could far surpass the gains of these other metals as their is a record short that may soon have to cover if the US dollar finally breaks down. Silver may be the cheapest and best opportunity in the market right now from a value perspective. If you notice the silver to gold ratio has not reached this high since 2008 and 2002.

Read more

Silver Stocks May Be Cheapest Opportunity In Decade