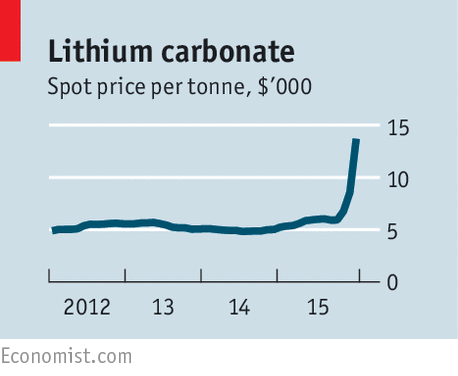

One metal where demand is soaring is lithium which is used in rechargeable batteries for smartphones, Ipads and electric vehicles. A game changing event occurred this past week when Albemarle (ALB) paid over $6.2 billion to buy the world's largest publicly traded lithium producer Rockwood Holdings (ROC).

This is one of the largest chemical deals and the lithium industries biggest M&A transaction in history. Demand has doubled in the past decade as lithium ion battery use has grown in mobile technology. Growth in the lithium sector has been far outpacing other sectors. Some experts believe demand could even grow faster over the next decade especially as electric vehicles gain market share. The key for investors is finding potential sources of the raw material in North America.

Read more

This Lithium Asset in Nevada Could Supply Tesla’s Gigafactory